P5-75B. (Learning Objective 4: Accounting for revenue, collections, and uncollectibles) This problem takes you through the accounting

Question:

P5-75B. (Learning Objective 4: Accounting for revenue, collections, and uncollectibles)

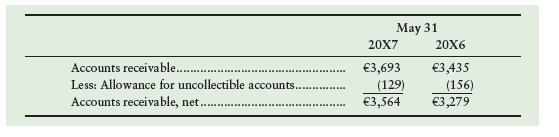

This problem takes you through the accounting for sales, receivables, and uncollectibles for On-time Delivery Corp, the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its accounts receivable. At May 31, 20X6 and 20X7, respectively, On-time Delivery Corp. reported the following on its Balance Sheet

(in millions of euros):

During the year ended May 31, 20X7, On-time Delivery Corp. earned sales revenue and collected cash from customers. Assume that On-time Delivery Corp. wrote off uncollectible receivables. At year-end, On-time Delivery Corp. ended with the foregoing May 31, 20X7, balances.

Requirements 1. Prepare T-accounts for Accounts Receivable and Allowance for Uncollectibles, and insert the May 31, 20X6, balances as given.

2. Journalize the following transactions of On-time Delivery for the year ended May 31, 20X7. (Explanations are not required.)

a. Service revenue on account, €32,587 million.

b. Collections from customers on account, €31,979 million.

c. Write-offs of uncollectible accounts receivable, €350 million.

d. Uncollectible-account expense, €323 million.

3. Post to the Accounts Receivable and Allowance for Uncollectibles T-accounts.

4. Compute the ending balances for the two T-accounts and compare your balances to the actual May 31, 20X7, amounts. They should be the same.

5. Show what On-time Delivery should report on its Income Statement for the year ended May 31, 20X7.

Step by Step Answer:

Financial Accounting International Financial Reporting Standards Global Edition

ISBN: 9781292211145

11th Edition

Authors: Charles T. Horngren, C. William Thomas, Wendy M. Tietz, Themin Suwardy, Walter T. Harrison