Delorme Specialties reported the following at December 31, 2021 (in thousands): Requirement Determine the following items for

Question:

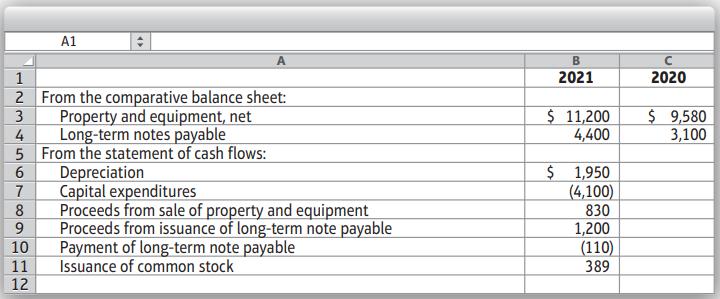

Delorme Specialties reported the following at December 31, 2021 (in thousands):

Requirement

Determine the following items for Delorme Specialties during 2021:

a. Gain or loss on the sale of property and equipment

b. Amount of long-term debt issued for something other than cash.

Transcribed Image Text:

1 2 3 4 5 56789ULL 10 11 12 12 A1 From the comparative balance sheet: Property and equipment, net Long-term notes payable From the statement of cash flows: Depreciation Capital expenditures Proceeds from sale of property and equipment Proceeds from issuance of long-term note payable Payment of long-term note payable Issuance of common stock B 2021 $ 11,200 4,400 $ 1,950 (4,100) 830 1,200 (110) 389 2020 $ 9,580 3,100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

a b Gain on sale of property and equipment 300 Bal 12312...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Delorme Specialties reported the following at December 31, 2010 (in thousands): Requirement 1. Determine the following items for Delorme Specialties during 2010: a. Gain or loss on the sale of...

-

Delorme Specialties reported the following at December 31, 2018 (in thousands): Requirement 1. Determine the following items for Delorme Specialties during 2018: a. Gain or loss on the sale of...

-

Crown Specialties reported the following at December 31, 2016 (in thousands): 1. Determine the following items for Crown Specialties during 2016: a. Gain or loss on the sale of property and equipment...

-

Perez Manufacturing Company began operations on January 1. During the year, it started and completed 1,740 units of product. The financial statements are prepared in accordance with GAAP. The company...

-

If the vector is added to vector, the result is. If is subtracted from, the result is. What is the magnitude of A-bar?

-

Explain why it is better to allocate budgeted sup- port department costs rather than actual support department costs. lop8

-

6. For nongovernmental NFP, how are unconditional promises to give with collections due in the next period accounted for?

-

Gibralter Insurance Company uses a flexible overhead budget for its application-processing department. The firm offers five types of policies, with the following standard hours allowed for clerical...

-

Dan owns 50% of R Corp's stock. On June 21,20X1, Dan transferred land worth $60,000 to R in exchange for 35% of R's stock (FMV of $50,000) and $10,000 cash. Dan's basis in the land was $35,000. What...

-

For the following situation, develop a prior-year's reconstructed operating statement, assuming typically competent, professional management. Based on the reconstructed net operating income and the...

-

The 2021 income statement and the 2021 comparative balance sheet of Ghent River Camp, Inc., have just been distributed at a meeting of the camps board of directors. The directors raise a fundamental...

-

Luxe, Inc., reported the following in its financial statements for the year ended May 31, 2021 (in thousands): Requirement Determine the following cash receipts and payments for Luxe during the...

-

Jaguar Land Rover opened its first plant in China in 2014. Discuss the main reasons behind this decision.

-

The following information appears in the records of Poco Corporation at year-end: a. Calculate the amount of retained earnings at year-end. b. If the amount of the retained earnings at the beginning...

-

For the following four unrelated situations, A through D, calculate the unknown amounts appearing in each column: A B D Beginning Assets... $38,000 $22,000 $38,000 ? Liabilities.. 22,000 15,000...

-

On December 31, John Bush completed his first year as a financial planner. The following data are available from his accounting records: a. Compute John's net income for the year just ended using the...

-

Statement of Stockholders' Equity and Balance Sheet The following is balance sheet information for Flush Janitorial Service, Inc., at the end of 2019 and 2018: Required a. Prepare a balance sheet as...

-

Petty Corporation started business on January 1, 2019. The following information was compiled by Petty's accountant on December 31, 2019: Required a. You have been asked to assist the accountant for...

-

What is the enterprise information security policy, and how is it used?

-

Ex. (17): the vector field F = x i-zj + yz k is defined over the volume of the cuboid given by 0x a,0 y b, 0zc, enclosing the surface S. Evaluate the surface integral ff, F. ds?

-

Using the data in BE4-12, identify the accounts that would be included in a post-closing trial balance.

-

Using the data in BE4-12, identify the accounts that would be included in a post-closing trial balance.

-

The income statement for the Timberline Golf Club Inc. for the month ended July 31 shows Service Revenue $16,000; Salaries and Wages Expense $8,400; Maintenance and Repairs Expense $2,500; and Income...

-

When preparing government-wide financial statements, the modified accrual based governments funds are adjusted. Please show the adjustments (in journal entry form with debits and credits) that would...

-

I need help finding the callable price and call value

-

On 31 October 2022, the owner took goods for his son as a birthday gift. The cost price of the goods was R15 000

Study smarter with the SolutionInn App