Hopewell Shipping Corporation is an overnight shipper. Since it sells on credit, the company cannot expect to

Question:

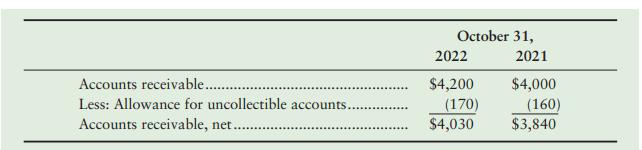

Hopewell Shipping Corporation is an overnight shipper. Since it sells on credit, the company cannot expect to collect 100% of its accounts receivable. At October 31, 2021, and 2022, Hopewell reported the following on its balance sheet (in millions of dollars):

During the year ended October 31, 2022, Hopewell earned service revenue and collected cash from customers. Assume uncollectible-account expense for the year was 5% of service revenue on account and Hopewell wrote off uncollectible receivables and made other adjustments as necessary (see below). At year-end, Hopewell ended with the foregoing October 31, 2022, balances.

Requirements

1. Prepare T-accounts for Accounts Receivable and Allowance for Uncollectible Accounts, and insert the October 31, 2021, balances as given.

2. Journalize the following transactions of Hopewell for the year ended October 31, 2022 (explanations are not required):

a. Service revenue was $32,500 million, of which 8% is cash and the remainder is on account.

b. Collections from customers on account were $28,123 million. No sales discounts were taken.

c. Uncollectible-account expense was 5% of service revenue on account.

d. Write-offs of uncollectible accounts receivable were $1,485 million.

e. On October 1, Hopewell received a 2-month, 9%, $135 million note receivable from a large corporate customer in exchange for the customer’s past due account; Hopewell made the proper year-end adjusting entry for the interest on this note.

f. Hopewell’s October 31, 2022, year-end bank statement reported $43 million of nonsufficient funds (NSF) checks from customers. 3. Post your entries to the Accounts Receivable and Allowance for Uncollectible Accounts T-accounts.

4. Compute the ending balances for Accounts Receivable and Allowance for Uncollectible Accounts and compare your balances to the actual October 31, 2022, amounts. They should be the same. How much does Hopewell expect to collect from its customers after October 31, 2022?

5. Show the net effect of these transactions on Hopewell’s net income for the year ended October 31, 2022.

Step by Step Answer: