Halsey Building Company signed a contract to build an office building for $40,000,000. The scheduled construction costs

Question:

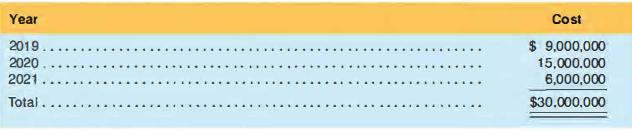

Halsey Building Company signed a contract to build an office building for $40,000,000. The scheduled construction costs follow.

The building should be completed in 2021.

For each year, compute the revenue, expense, and gross profit reported for this construction project under each of the following assumptions:

a. Halsey's performance obligation to build the office building is fulfilled as construction proceeds, and the cost incurred is an accurate reflection of the value transferred to the customer.

b. Halsey's contract docs not transfer ownership rights to the customer until the building is completed.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 9781618531650

5th Edition

Authors: Michelle Hanlon, Robert Magee, Glenn Pfeiffer, Thomas Dyckman

Question Posted: