Selected balance sheet amounts for Alibaba Group Holding Ltd, a China-based online and mobile commerce company, for

Question:

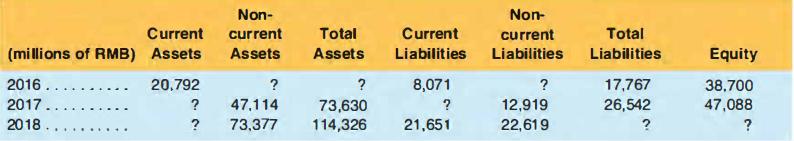

Selected balance sheet amounts for Alibaba Group Holding Ltd, a China-based online and mobile commerce company, for three recent fiscal years ending March 31 follow:

REQUIRED:

a. Compute the missing balance sheet amounts for each of the three years shown.

b. What asset category do you expect to constitute the majority of the company's current assets?

c. Calculate Alibaba's current ratio for fiscal years 2016 and 2018.

d. Calculate net working capital for 2016 and 2018.

Non- Non- Current current Total Current Total current Liabilities (millions of RMB) Assets Assets Assets Liabilities Liabilities Equity 2016.... 20,792 ? 8,071 ? 17,767 38,700 2017 ? 47,114 12,919 26,542 47,088 73,630 114,326 2018. ? 73,377 21,651 22,619 ..... ...

Step by Step Answer:

a b Alibabas current assets are likely to be primarily comprised of cash ...View the full answer

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman

Related Video

The current ratio is a financial ratio that measures a company\'s ability to pay its short-term obligations with its short-term assets. It is calculated by dividing a company\'s current assets by its current liabilities. The formula for calculating the current ratio is: Current Ratio = Current Assets / Current Liabilities Current assets are assets that can be converted to cash within one year, while current liabilities are debts that are due within one year. A current ratio of 1:1 or greater is generally considered good, as it indicates that a company has enough current assets to cover its current liabilities. A current ratio of less than 1:1 may suggest that a company may have difficulty meeting its short-term obligations. It\'s important to note that the current ratio is just one of many financial ratios that can be used to assess a company\'s financial health. It should be used in conjunction with other financial ratios and qualitative factors to make informed decisions about investing or lending to a company.

Students also viewed these Business questions

-

Balance sheet relations Selected balance sheet amounts for Kajima Corporation, a Japanese construction firm, are show n in the following table for four recent years. Kajima applies Japanese...

-

Do you expect to observe more or less voluntary disclosure by companies in emerging-market countries than in developed countries? Why? Do you expect to observe more or less regulatory disclosure...

-

Selected balance sheet amounts for SinoTwelve, a Chinese manufacturer, appear next. All amounts are in thousands of U.S. dollars ($). Compute the missingamounts. 2013 2012 $5,450,838 Current...

-

True or False Financial ratios are the principal tools of financial analysis because they standardize financial information so that comparisons can be made between firms of varying sizes.

-

Calculate the impulse-response functions. Explain the four functions and discuss your findings. Comment on whether the ordering of the series matters for your results.

-

A basketball of mass 0.60 kg is dropped from rest from a height of 1.05 m. It rebounds to a height of 0.57 m. (a) How much mechanical energy was lost during the collision with the floor? (b) A...

-

What is the link between the consumption-based CAPM and risk aversion? Explain.

-

Emily Pemberton is an IS project manager facing a difficult situation. Emily works for the First Trust Bank, which has recently acquired the City National Bank. Prior to the acquisition, First Trust...

-

Question 13 The following data have been taken from the badest reports shown Purchases Sales January $160.000 $100.000 February $160.000 $200.000 March $160.000 $240.000 April $140.000 $300.000 May...

-

December 31, 2014, trial balances for Pledge Company and its subsidiary Stom Company follow: Pledge Company purchased 72,000 shares of Stom Company's common stock on January 1, 2011, for $300,000. On...

-

Selected income statement information for Nike, Inc., a manufacturer of athletic footwear, for four recent fiscal years ending May 31 follows. REQUIRED a. Compute the: missing amounts for each of the...

-

Selected balance sheet amounts for Apple Inc., a retail company. for four recent fiscal years follow: REQUIRED: a. Compute the missing balance sheet amounts for each of the four years shown. b. What...

-

The International Federation of Accountants (IFAC) is a worldwide organization of professional accounting bodies. IFACs Web site (www.ifac.org) has links to a number of accounting bodies around the...

-

What Do You Know About Amazon Associate Program? What Would You Do To Increase Your Earnings With Amazon Associate Program? Is Affiliate Marketing And Referral Marketing One And The Same? What is...

-

As a leader, what do you think are important elements of a leadership team made up of those senior people that you will surround yourself with? Do you have (or have you had) a mentor? If so, how have...

-

What role do interorganizational relationships and alliances play in achieving strategic goals, and how do organizations manage these relationships to ensure mutual benefit and minimize risks ?

-

How do expatriate managers normally rotate into the operations of a foreign country? How long do they typically stay in the country? What are the disadvantages? How did Shane Tedjarati rotate into...

-

If you are not Asian, do you know someone well who is Asian? In what capacity do you know them (e.g., personal friend, manager, classmate, neighbor, etc.)? Do you know their ethnic origin (e.g.,...

-

P On October 31, the stockholders equity section of Manolo Companys balance sheet consists of common stock $648,000 and retained earnings $400,000. Manolo is considering the following two courses of...

-

Below is a sample of the data in the file NFLAttendance which contains the 32 teams in the National Football League, their conference affiliation, their division, and their average home attendance....

-

Do the terms FIFO and LIFO refer to techniques used in determining quantities of the various classes of merchandise on hand? Explain.

-

If merchandise inventory is being valued at cost and the price level is decreasing, which of the three methods of costingFIFO, LIFO, or average costwill yield (a) The highest inventory cost, (b) The...

-

Which of the three methods of inventory costingFIFO, LIFO, or average cost will in general yield an inventory cost most nearly approximating current replacement cost?

-

Current Attempt in Progress On July 3 1 , 2 0 2 2 , Crane Compary had a cash balance per books of $ 6 , 2 4 5 . 0 0 . The statement from Dakata State Bark on that date showed a balance of $ 7 , 7 9 5...

-

Cede & Co. expects its EBIT to be $89,000 every year forever. The firm can borrow at 5 percent. Cede currently has no debt, and its cost of equity is 10 percent. If the tax rate is 35 percent, what...

-

In the Marriott example, one discussion point considered when a firm might use a single hurtle rather than different divisional or business unit rates. When a single rate is used and the divisions...

Study smarter with the SolutionInn App