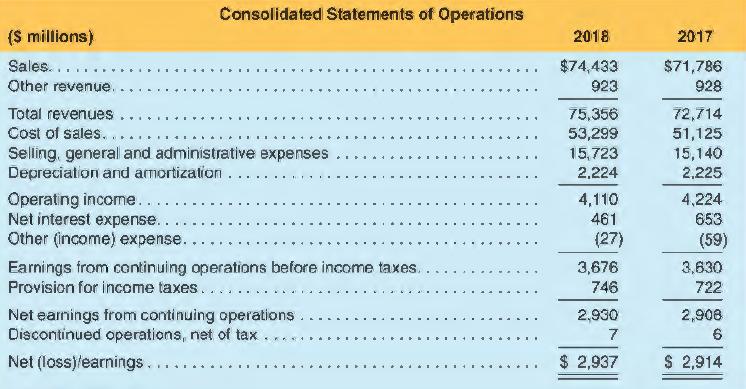

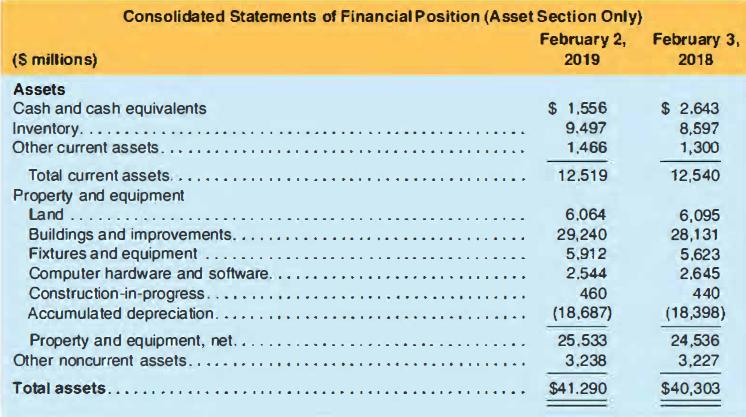

The 2018 and 2017 income statements and balance sheets (asset section only) for Target Corporation follow, along

Question:

The 2018 and 2017 income statements and balance sheets (asset section only) for Target Corporation follow, along with its footnote describing Target's accounting for property and equipment. Target's cash flow statement for fiscal 2018 reported capital expenditures of $3,516 million and disposal proceeds for property and equipment of $85 million. No gain or loss was reported on property and equipment disposals. In addition, Target acquired property and equipment through non-cash acquisitions not reported on the statement of cash flows.

11. Property and Equipment

11. Property and Equipment

Property and equipment is depreciated using the straight-line method over estimated useful lives or lease terms if shorter. We amortize leasehold improvements purchased after the beginning of the initial lease term over the shorter of the assets' useful lives or a term that includes the original lease term. plus any renewals that are reasonably assured at the date the leasehold improvements are acquired. Depreciation expense for 2018, 2017 and 2016 was $2,460 million, $2,462 million, and $2,305 million, respectively, including depreciation expense included in Cost of Sales. For income tax purposes, accelerated depreciation methods are generally used. Repair and maintenance costs are expensed as incurred. Facility pre-opening costs. including supplies and payroll, are expensed as incurred.

We review long-lived assets for impairment when events or changes in circumstances-such as a decision to relocate or close a store or distribution center, make significant software changes or discontinue projects-indicate that the asset's carrying value may not be recoverable. We recognized impairment losses of $92 million, $91 million, and $43 million during 2018, 2017, and 2016, respectively. , .. Impairments are recorded in SG&A Expenses on the Consolidated Statements of Operations.

REQUIRED:

a. Prepare journal entries to record the following for 2018:

i. Depreciation expense

ii. Capital expenditures

iii. Disposal of property. plant, and equipment

iv. Impairments and write-downs (Assume that impairments and write-downs reduce the property and equipment account, rather than increasing accumulated depreciation.)

b. Estimate the amount of property and equipment that was acquired. if any, through non-cash

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman