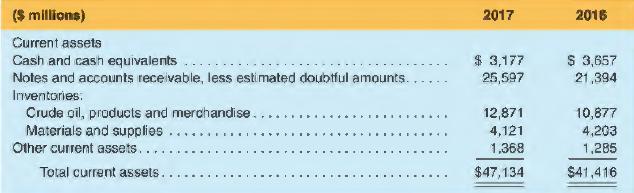

The current assets of Exxon Mobil Corporation follow: In addition, the following note was provided in its

Question:

The current assets of Exxon Mobil Corporation follow:

In addition, the following note was provided in its 2017 10-K report:

Inventories. Crude oil, products and merchandise inventories are carried at the lower of current market value or cost (generally determined under the last-in, first-out method-LIFO). Inventory costs include expenditures and other charges (including depreciation) directly and indirectly incurred in bringing the inventory to its existing condition and location. Selling expenses and general and administrative expenses are reported as period costs and excluded from inventory cost. Inventories of materials and supplies are valued at cost or less.

In 2017, 2016 and 2015, net income included losses of $10 million, $295 million and $186 million, respectively, attributable to the combined effects of LIFO inventory accumulations and drawdowns. The aggregate replacement cost of inventories was estimated to exceed their LIFO carrying values by $10.8 billion and $8.1 billion at December 31, 2017, and 2016, respectively.

REQUIRED

a. Exxon Mobil reported pretax earnings of $18,674 million in 2017. What amount of pretax earnings would have been reported by the company if inventory had been reported using the FIFO costing method?

b. Exxon Mobil reported cost of goods sold of $128,217 million in 2017. Compute its inventory turnover ratio for 2017 using total inventories.

c. BP, p.l.c. (BP) reports its financial information using IFRS. For fiscal year 2017, BP reported cost of goods sold of $179,716 million, beginning inventory of $17,655 million and ending inventory of $19,011 million. Compute BP's inventory turnover ratio for fiscal year 2017.

d. Compare your answers in parts band c. BP can't use LIFO to report under IFRS, so revise your calculations in such a way as to find out which company has faster inventory turnover.

e. What is meant by the statement that "2017 net income included losses of $10 million attributable to the combined effects of LIFO inventory accumulations and draw-downs"?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman