Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do you need more information or are you working on this? Irene Watts and John Lyon are forming a partnership to which Watts will devote

do you need more information or are you working on this?

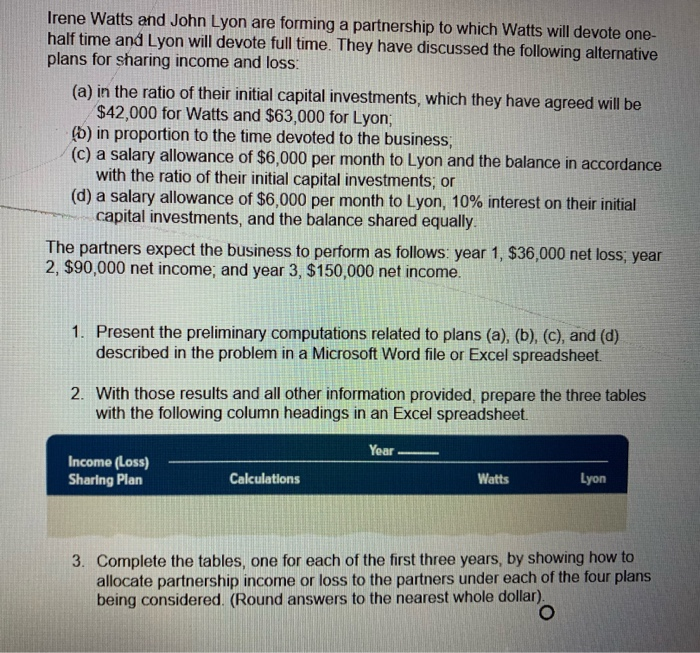

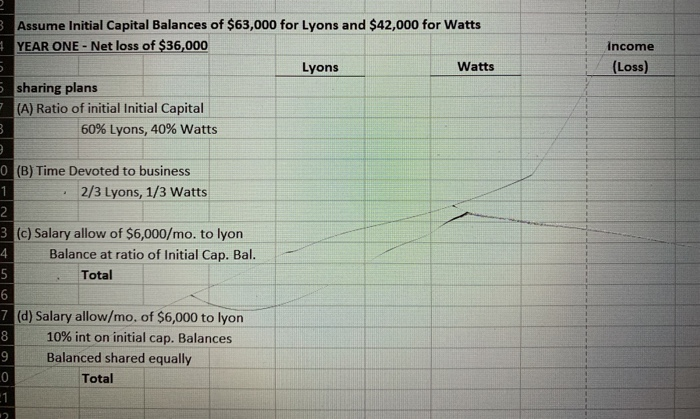

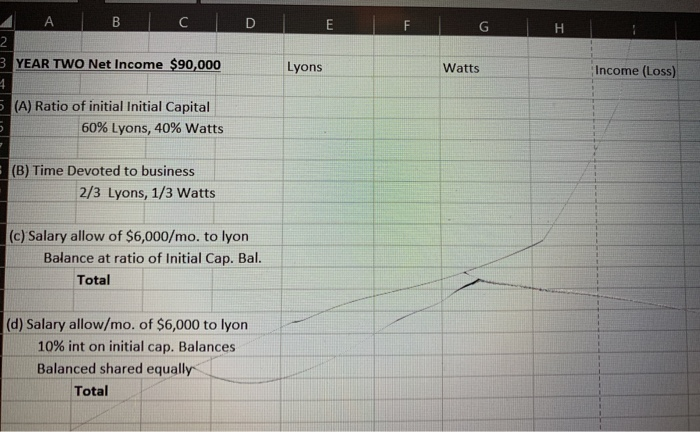

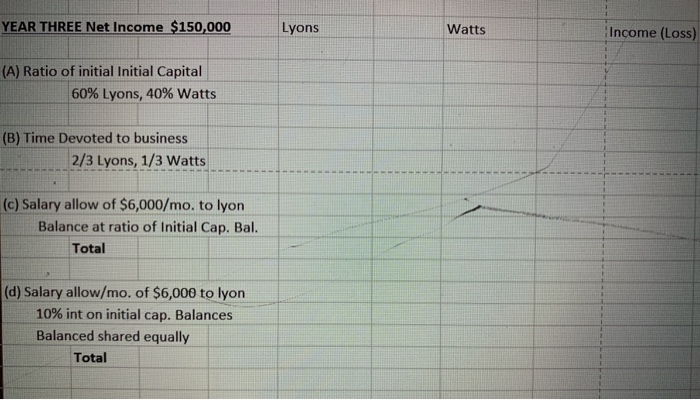

Irene Watts and John Lyon are forming a partnership to which Watts will devote one- half time and Lyon will devote full time. They have discussed the following alternative plans for sharing income and loss: (a) in the ratio of their initial capital investments, which they have agreed will be $42,000 for Watts and $63,000 for Lyon; (6) in proportion to the time devoted to the business, (c) a salary allowance of $6,000 per month to Lyon and the balance in accordance with the ratio of their initial capital investments, or (d) a salary allowance of $6,000 per month to Lyon, 10% interest on their initial capital investments, and the balance shared equally. The partners expect the business to perform as follows: year 1, $36,000 net loss, year 2, $90,000 net income, and year 3, $150,000 net income. Present the preliminary computations related to plans (a), (b), (c), and (d) described in the problem in a Microsoft Word file or Excel spreadsheet. 2. With those results and all other information provided, prepare the three tables with the following column headings in an Excel spreadsheet. Year Income (Loss) Sharing Plan Calculations Watts Lyon 3. Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. (Round answers to the nearest whole dollar). Income (Loss) 3 Assume Initial Capital Balances of $63,000 for Lyons and $42,000 for Watts YEAR ONE - Net loss of $36,000 Lyons Watts 5 sharing plans - (A) Ratio of initial Initial Capital 60% Lyons, 40% Watts 0 (B) Time Devoted to business 2/3 Lyons, 1/3 Watts 3 (c) Salary allow of $6,000/mo, to lyon Balance at ratio of Initial Cap. Bal. Total 7 (d) Salary allow/mo. of $6,000 to lyon 10% int on initial cap. Balances Balanced shared equally Total D E F G H A B C 2 3 YEAR TWO Net Income $90,000 Lyons Watts Income (Loss) 5 (A) Ratio of initial Initial Capital 60% Lyons, 40% Watts (B) Time Devoted to business 2/3 Lyons, 1/3 Watts (c) Salary allow of $6,000/mo. to lyon Balance at ratio of Initial Cap. Bal. Total (d) Salary allow/mo. of $6,000 to lyon 10% int on initial cap. Balances Balanced shared equally Total YEAR THREE Net Income $150,000 Lyons Watts Income (Loss) (A) Ratio of initial Initial Capital 60% Lyons, 40% Watts (B) Time Devoted to business 2/3 Lyons, 1/3 Watts (c) Salary allow of $6,000/mo. to lyon Balance at ratio of Initial Cap. Bal. Total (d) Salary allow/mo. of $6,000 to lyon 10% int on initial cap. Balances Balanced shared equally Total Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started