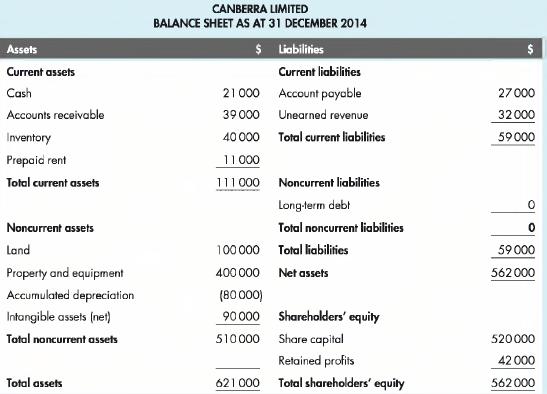

The following transactions occurred for Canberra Limited in 2015: a. Issued share capital for $200 000 cash,

Question:

The following transactions occurred for Canberra Limited in 2015:

a. Issued share capital for $200 000 cash,

b. Purchased $35 000 of inventory on credit,

c. Paid $28 000 to accounts payable.

d. Sold inventory costing $60 000 for $270 000. All sales are on credit.

e. Collected $52 000 from customers.

f. Prepaid $12 000 rent for the year commencing 1 January 2015.

g. Depreciated property and equipment for the year using the straight-line method (20 per cent per annum).

h. Dividends declared and paid totalled $30 000.

i. Borrowed $100 000 on 1 July 2014. The loan is due on 30 June 2016 and carries a 10 per cent p.a. interest rate. Paid $4000 interest on this loan during 2015.

j. On 1 November paid $24000 for an insurance policy covering 1 November 2014 to 31 October 2015.

k. Paid wages of $90 000; wages of $20 000 had been earned but not paid.

I. Received interest of $5000 in cash from the bank.

On 31 December 2015:

m. The unearned revenue account had a balance of $5000.

n. Accrued interest revenue had a balance of $2000.

Required:

1. Prepare journal entries for the above transactions.

2. Prepare ledgers.

3. Prepare closing entries.

4. Prepare a 10-column worksheet.

5. Prepare an income statement and balance sheet for Canberra Limited for the year ended 31 December 2015.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson