Wan Chai Limited is a small wholesaler of electronic components located near Hong Kong's central business district.

Question:

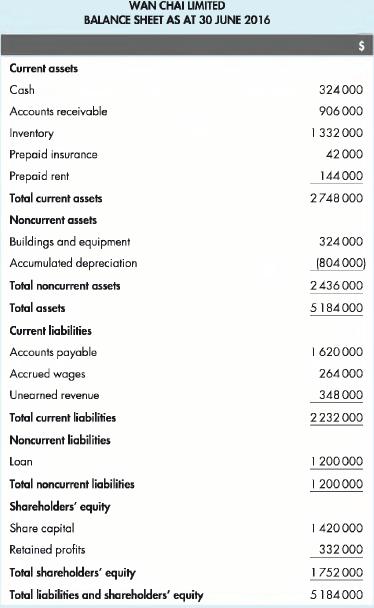

Wan Chai Limited is a small wholesaler of electronic components located near Hong Kong's central business district. The firm has provided a year-end balance sheet at 30 June 2016 and a summary of all the transactions that occurred in the month of July 2016.

The transactions are as follows:

a. Paid wages outstanding at the end of June.

b. Made credit sales of $125 000. (The cost of those goods sold was $750 000.)

c. Paid $1 020 000 to accounts payable,

d. Purchased $480 000 inventory on credit.

e. Paid cash for an annual insurance premium of $504 000 (12-month policy commencing 1 August 2016).

f. Received $1 680 000 from debtors.

g. Made cash sales totalling $270 000. (The cost of those goods sold was $192 000.)

h. Interest on the loan is at 10 percent per annum and will be paid in September,

i. The work related to unearned revenue was completed.

j. Paid wages expense of $186 000 for July. Wages owing at the end of July are $60 000.

k. Paid rent for August of $144 000. (Rent is payable monthly in advance, at $ 144 000 per month.)

I. Paid administrative expenses, incurred during the month, of $126 000.

m. Depreciation is calculated monthly at 20 percent per annum for plant and equipment, based on cost,

n. Commissions are determined on the last day of the month at $13 200. They will be paid next month,

o. The company is owed $10000 in interest from the bank at the end of July.

Using Wan Chai Limited's previous balance sheet as a starting point, prepare the following data for the month ending 31 July 2016:

1. Journal entries and ledger accounts.

2. Post-adjustment trial balance.

3. Balance sheet and Income statement.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson