The following transactions occurred for Gilchrest Ltd (assume all beginning balances = 0) during the year ended

Question:

The following transactions occurred for Gilchrest Ltd (assume all beginning balances = 0) during the year ended 31 December 2016.

a. Issued shares for $700 000 cash.

b. Signed a contract on 1 October 2016 for $200 000 to supply consulting advice. Received an advance of $30 000. At 31 December none of the consulting advice had yet been provided,

c. Purchased $200 000 of inventory; paid $90000 cash with the remainder on account,

d. Sold $300 000 of products to customers on account; cost of products was $140 000.

e. Collected $120 000 cash from customers in point (d).

f. Paid $70000 in wages to employees during the year; at year-end wages of $8000 are owed to employees for work done in December 2016, to be paid in 2017.

g. Earned $10 000 interest on investments, receiving 70 percent in cash.

h. Received an electricity bill in December 2016 for $4000 covering electricity charges for December 2016. The bill will be paid in January 2017.

i. Paid $20 000 cash for supplies received during 2016. At year-end $7000 of supplies were still on hand (i.e. had not been used up).

j. Declared and paid $30 000 in cash dividends to shareholders.

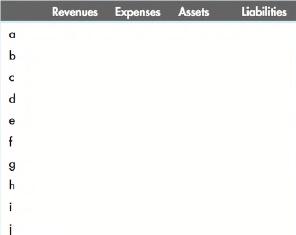

For each of the above transactions, events or facts, indicate the impact on revenues, expenses, assets and liabilities during 2016 by placing a + or - sign (+ for increase and - for decrease) to indicate direction in the appropriate box. Write NE if there is no effect. Include dollar amounts.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson