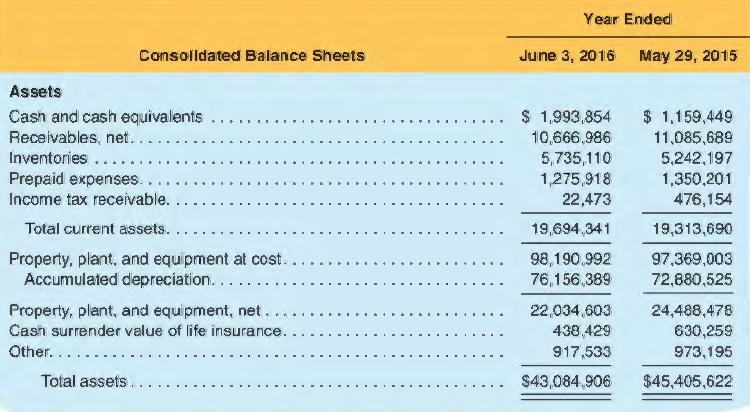

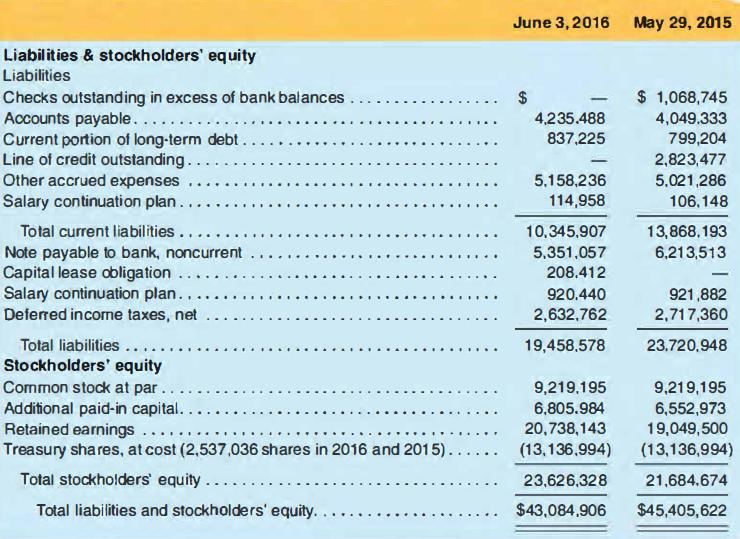

The table below provides the balance sheets for Golden Enterprises, Inc. for the fiscal years ended June

Question:

The table below provides the balance sheets for Golden Enterprises, Inc. for the fiscal years ended June 3, 2016, and May 29, 2015.

Additional information:

1. Net income for the year ended June 3, 2016. was $3,184,803.

2. Depreciation expense for the year ended June 3, 2016. was $3,876,111.

3. Accounts for other assets, for the life insurance asset, and for salary continuation liabilities (both current and noncurrent) should be classified as operating.

4. Checks outstanding in excess of bank balances should be treated as an operating liability.

5. During the year ended June 3, 2016, Golden Enterprises sold used property. plant. and equipment, receiving $56,446 in cash and recognizing a gain of $56,446.

6. For the year ended June 3, 2016. debt proceeds (encompassing the liabilities for current portion of long-term debt. line of credit outstanding, and note payable to bank, noncurrent) were zero and debt repayments were $3,647,912.

7. During the fiscal year ending June 3, 2016. Golden Enterprises acquired a long-term asset in a noncash transaction. At the time of the transaction. the asset and the liability were both valued at $239,382. The asset is included under property, plant, and equipment in the balance sheet. and it is being depreciated. The associated financial liability is included on the balance sheet under the "capital lease obligation'' liability. During the year ending June 3, 2016, Golden Enterprises repaid $30,970 of principal on this obligation.

8. During the year ended June 2, 2016, Golden Enterprises recognized an expense of $253,011 for stock-based compensation. The expense increased additional paid-in capital by the same amount.

REQUIRED:

a. Set up a spreadsheet to analyze the changes in Golden Enterprises· comparative balance sheets.

b. Prepare a statement of cash flows (including operations. investing and financing) for Golden Enterprises for the year ended June 3, 2016, using the indirect method for the operating section.

c. Using information in the statement of cash flows prepared in part b, compute (1) the operating cash flow to current liabilities ratio and (2) the operating cash flow to capital expenditures ratio.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman