An extract of the year-end Trial Balance is shown. A new machine had been acquired for 180,000

Question:

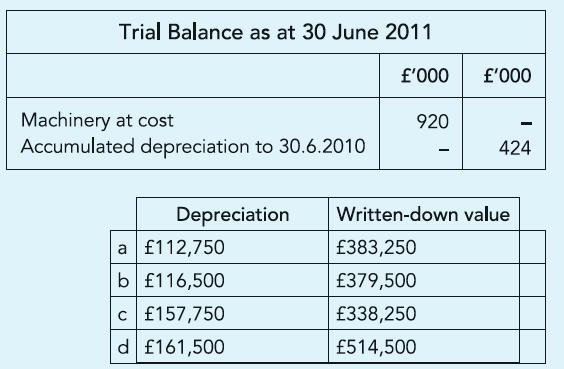

An extract of the year-end Trial Balance is shown. A new machine had been acquired for £180,000 on 1 September 2010. Machinery is depreciated at 25% on the reducing balance method with proportionate depreciation in the year of acquisition. The financial statements for the year ended 30 June 2011 will report:

Transcribed Image Text:

Trial Balance as at 30 June 2011 Machinery at cost Accumulated depreciation to 30.6.2010 Depreciation a £112,750 b £116,500 c £157,750 d £161,500 £'000 £'000 920 424 Written-down value £383,250 £379,500 £338,250 £514,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

b 1...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

An extract of the year end trial balance is shown on the right. A new machine had been acquired for 180,000 on 1st September 2010. Machinery is depreciated at 10% of cost with proportionate...

-

An extract of the year-end Trial Balance is shown. A new machine had been acquired for 180,000 on 1 September 2010. Machinery is depreciated at 10% of cost with proportionate depreciation in the year...

-

The M&M theory 1 suggest that there is irrelevance in value of firm despite changes in capital structure. How is this so? ref:Modigliani and Miller (M&M) studied capital structure theory...

-

Adam and Mandeep are in a partnership in retailing computer accessories. The partnership records, exclusive of GST, for this income year, disclose: Receipts ($): 530,000 Payments ($): 175,000 70,000...

-

A bond with face value $1,000 has a current yield of 7 percent and a coupon rate of 8 percent. What is the bonds price?

-

Why is meaning important in innovative pursuits?

-

Usability Professionals, salary survey. The Usability Professionals Association (UPA) supports people who research, design, and evaluate the user experience of products and services. The UPA...

-

Gonzalvo Corporations balance sheet at the end of 2013 included the following items. The following information is available for 2014. 1. Treasury stock was purchased at a cost of $13,200. 2. Cash...

-

IFRS vs. GAAP: Highlight key differences between International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), and discuss the implications for multinational...

-

A builder owns three cranes, particulars of which are stated on the right. The cranes are depreciated at 25% per annum using the reducing balance method, with time apportioning in the year of...

-

Gateway owns three trucks acquired as stated below. They depreciate their trucks at 25% per year, using the reducing balance method and time apportioning in the year of acquisition. What will be the...

-

What was innovative about Taylor's scientific management?

-

Saskatchewan Soy Products (SSP) buys soy beans and processes them into other soy products. Each tonne of soy beans that SSP purchases for $300 can be converted for an additional $200 into 500 lbs of...

-

Pharoah Acres sponsors a defined-benefit pension plan. The corporation's actuary provides the following information about the plan: January 1, 2025 December 31, 2025 Vested benefit obligation $510...

-

Company panther is compelled to pick between two machines An and B. The two machines are planned in an unexpected way, yet have indistinguishable limit and do the very same work. Machine A costs...

-

On April 30, 2023, a company issued $600,000 worth of 5% bonds at par. The term of the bonds is 9 years, with interest payable semi- annually on October 31 and April 30. The year-end of the company...

-

Identify the following; MethodBodyReturn statementReturn typeParameter Look at this example we saw in our Methods lesson: public double findTheArea (double length, double w idth) { double area =...

-

If smart phone sales are increasing but automobile sales are declining, is the economy growing or contracting?

-

The 2017 financial statements of the U.S. government are available at: https://www.fiscal.treasury.gov/fsreports/rpt/finrep/fr/fr_index.htm Use these to answer the following questions: a. Statement...

-

The following transactions relate to Hana Microelectronic Public Company Limited (Hana Microelectronic), an electronics and semiconductor firm headquartered in Thailand. Indicate whether each...

-

The following hypothetical events relate to the Berlin Philharmonic. Indicate whether each transaction immediately gives rise to a liability under U.S. GAAP and, separately, IFRS. If the Berlin...

-

Consider the following hypothetical scenario for Royal Dutch Shell (Shell), a Netherlands-based oil and gas firm. One of Shells oil rig platforms collapsed, creating damage to the seafloor as well as...

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App