Analysis of financial statement disclosures related to marketable securities. Citibank reports the following information relating to its

Question:

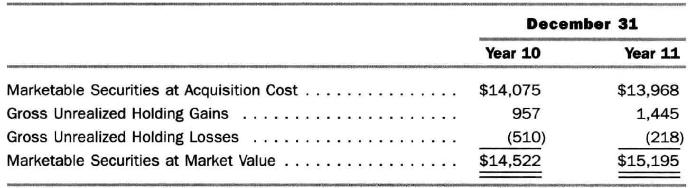

Analysis of financial statement disclosures related to marketable securities. Citibank reports the following information relating to its marketable securities classified as Securities Available for Sale for a recent year (amounts in millions):

Cash proceeds from sales and maturities of marketable securities totaled \(\$ 37,600\) million in Year 11. Gross realized gains totaled \(\$ 443\) million and gross realized losses totaled \(\$ 113\) million during Year 11. The book value of marketable securities sold or matured totaled \(\$ 37,008\) million. Interest and dividend revenue during Year 11 totaled \(\$ 1,081\) million. Purchases of marketable securities totaled \(\$ 37,163\) million during Year 11 .

a. Give the journal entries to record the sale of marketable securities during Year 11.

b. Analyze the change in the net unrealized holding gain from \(\$ 447\) million on December 31, Year 10, to \(\$ 1,227\) million on December 31, Year 11 .

c. Compute the total income (both realized and unrealized) occurring during Year 11 on Citibank's investments in securities.

d. How might the judicious selection of marketable securities sold during Year 11 permit Citibank to report an even larger net realized gain?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil