Analysis of nonrecurring transactions; introduction to constructive liabilities. (Adapted from an idea and materials provided by Katherine

Question:

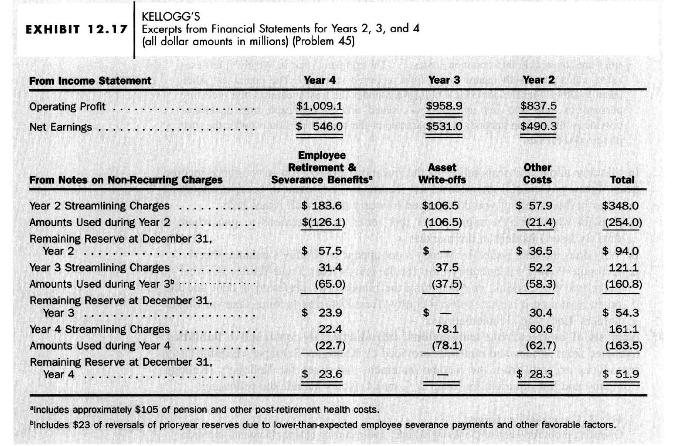

Analysis of nonrecurring transactions; introduction to constructive liabilities. (Adapted from an idea and materials provided by Katherine Schipper.) Exhibit 12.17 reproduces excerpts from the income statement and notes for Kellogg's (Kellogg Company and Subsidiaries) for Years 2, 3, and 4. Notes include the following:

Note 3. Non-recurring charges Operating profit for [each of the years] includes non-recurring charges [amounts appear in Exhibit 12.17] comprising . . . streamlining initiatives and . . . asset impairment losses. . . .

Streamlining initiatives From Year 2 to the present, management has commenced major productivity and operational streamlining initiatives in an effort to optimize the Company's cost structure and move toward a global business model. The incremental costs of these programs . . . [appear] as non-recurring charges.

[Kellogg's then gives details of the components of the streamlining initiatives in the U.S., Australia, Latvia, Denmark, and Italy.] Total cash outlays during Year 4 for streamlining initiatives were \(\$ 85\) million . . . [during Year 3] approximately \(\$ 120\) million . . . and [during Year 2 approximately] \(\$ 40\) million. . . . The components of the streamlining charges as well as the reserve balances [that is, credit balances in balance sheet liability accounts at the end of each of each year also appear in Exhibit 12.17].

In thinking about and responding to the questions below, ignore income taxes.

a. Give the journal entries made during Years 2, 3, and 4 for streamlining charges, cash payments, and asset write-downs and write-offs. Rather than use the word Reserve in your account titles, however, use the term Liability for Streamlining Costs.

b. If you did part a correctly, you already included the effect of the information about Year 3 from footnote [b] in Exhibit 12.17. That is, Kellogg's already includes the effects reported that note in the numbers in the schedule. Assume now that Kellogg's had first recorded its journal entry for Year 3 using the gross streamlining charge for that year, \(\$ 144.1\) ( \(=\$ 23.0+\$ 121.1)\) million, and then recorded the information about the reversal. Give the two implied journal entries to recognize the expense and the reversal. What was the effect on net income for Year 3 of this reversal? That is, without it, would income for Year 3 have been larger or smaller and by how much?

c. Assume that Kellogg's had known in Year 2 what it learned in Year 3 about the actual costs of Year 2's streamlining charges. That is, assume Kellogg's made streamlining charges in Year 2 just large enough so that it need not make any reversals in Year 3. What would have been the effect on net income for Year 2 and Year 3 of this reversal? That is, without the need for the reversal, changing the charges for Years 2 and 3, what would be the effect on income for both Year 2 and Year 3? Say whether larger or smaller and by how much. What would have been the income for each of the three years?

d. Compare the pattern of income you derive in part \(\mathbf{c}\) with the pattern Kellogg's actually reported. Would an investor or analyst likely give a higher valuation derived from data of Kellogg's reporting the actual income or from the data they would have reported under the assumptions of part \(\mathbf{c}\) ? Comment on the quality of earnings provided by the streamlining charges, the opportunity for income manipulation, and Kellogg's use (or not) of that opportunity.

e. Chapter 9 introduced the FASB's new concept of constructive liability-a cost management has no obligation to incur, but expects to incur, one that it can measure with reasonable precision, and which may require a future cash outlay. Using your analysis above, explain why some standard setters and many analysts fear that if the FASB allows firms to record constructive liabilities, then the quality of earnings will decline. What is the smallest extra charge for Year 2, reversed in Year 3, that would enable Kellogg's to report income rising from year to year, without any dips as compared to the base case in part c?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil