Analyzing changes in accounts receivable. Selected data from the financial statements of Whirlpool Corporation appear below (amounts

Question:

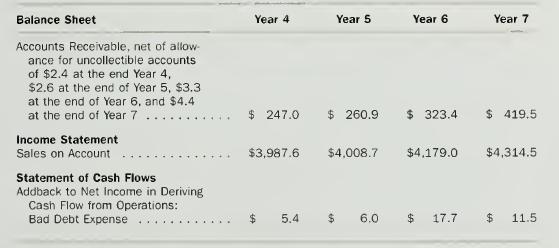

Analyzing changes in accounts receivable. Selected data from the financial statements of Whirlpool Corporation appear below (amounts in millions):

a. Prepare journal entries for Year 5, Year 6. and Year 7 for the following events:

(1) Sales on account (2) Provision for estimated uncollectible accounts (3) Write-off of actual bad debts (4) Collection of cash from customers

b. Compute the amount of the following ratios:

(1) Bad debt expense divided by sales on account for Year 5, Year 6, and Year 7 (2) Allowance for uncollectible accounts divided by accounts receivable (gross)

at the end of Year 5. Year 6. and Year 7

c. What do the ratios computed in part b suggest about the manner in which Whirlpool Corporation provides for estimated uncollectible accounts?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil