Analyzing inventory disclosures. Eli Lilly, a pharmaceutical company, uses a LIFO cost flow assumption. Amounts taken from

Question:

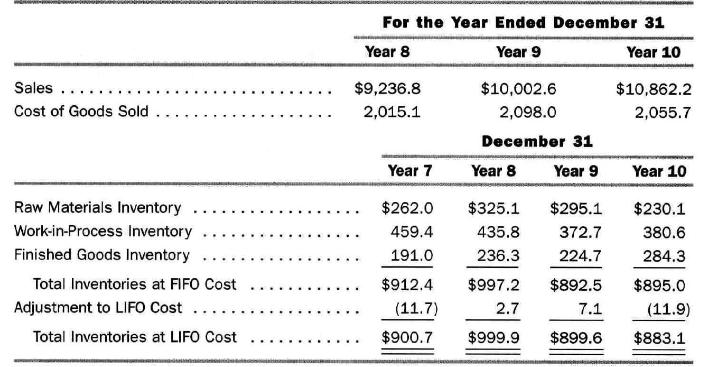

Analyzing inventory disclosures. Eli Lilly, a pharmaceutical company, uses a LIFO cost flow assumption. Amounts taken from a recent annual report appear below (in millions): \(\square\)

a. Compute the cost of goods sold for Year 8, Year 9, and Year 10 based on a FIFO cost flow assumption.

b. Did Eli Lilly appear to dip into LIFO layers in any of the three years? Explain.

c. Why is the adjustment from FIFO to LIFO a positive amount in some years and a negative amount in other years?

d. Compute the ratio of cost of goods to sales under both LIFO and FIFO for Year 8, Year 9, and Year 10.

e. Compute the inventory turnover ratio defined as cost of goods sold divided by average total inventories under both LIFO and FIFO for Year 8, Year 9, and Year 10.

f. Compute the costs of goods manufactured and sent to the finished goods storeroom during Year 8, Year 9, and Year 10. Use the amounts based on FIFO.

g. Compute an inventory turnover ratio for finished goods inventory defined as cost of goods sold divided by average finished goods inventory. Use the amounts based on FIFO.

h. Compute an inventory turnover ratio for work-in-process inventory defined as costs of goods manufactured (from part \(\mathbf{f}\) ) divided by average work-in-process inventory. Use the amounts based on FIFO.

i. Suggest reasons for the change in the cost of goods sold percentage computed in part \(\mathbf{d}\) and the change in the inventory turnover ratio computed in part \(\mathbf{e}\).

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil