Analyzing Revenue Recognition from FranchisingFranchise Fees, Lease Rentals, Software Sales. Boston Chicken. Inc., franchises and operates retail

Question:

Analyzing Revenue Recognition from Franchising—Franchise Fees, Lease Rentals, Software Sales. Boston Chicken. Inc., franchises and operates retail foodservice stores under the name Boston Market. These stores specialize in fresh, convenient meals featuring home-style entrees of chicken, turkey, ham, and meat loaf, as well as a variety of freshly prepared vegetables, salads, and other side dishes. Its product line also includes sandwiches, soups, and holiday home-replacement meals.

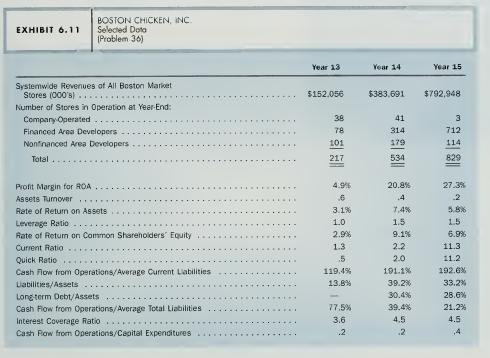

The total number of stores in the Boston Market system increased from 83 on December 27. Year 12, to 829 on December 31, Year 15. Gross systemwide store revenues increased from $42.7 million during the Year 12 fiscal year to $792.9 million during the Year 15 fiscal year. Franchisees owned and operated all but three of the Boston Market stores open at the end of Year 15. The company retains ownership of three stores to test-market new entrees, assess new operating procedures, and train employees.

Area Developers The company relies on area developers to achieve rapid penetration of targeted markets. Area developers are independently owned companies to which Boston Market grants an exclusive franchise in a particular geographical area to develop and operate Boston Market stores. An experienced retail food-service veteran with substantial invested equity capital heads each firm that is an area developer.

The company currently has 22 area developers. There are 829 stores open at the end of Year 15. The area developers have committed to opening an additional 934 stores within the next several years. These area developers have incurred substantial net losses during the recent rapid expansion of stores ($51.3 million in Year 14 and

$148.3 million in Year 15), and most have negative net worth. The company believes that the area developers will recover such losses as the rate of expansion moderates by reduction or elimination of development costs, increased operational efficiencies as a result of postexpansion operational focus, greater economies of scale, increased advertising efficiencies, and increased store revenue. The company anticipates that its current area developers will undertake domestic expansion of the Boston Market concept.

The Company does not, therefore, seek additional domestic area developers or franchisees.

Development Agreements Development agreements provide for the development of a specified number of stores within a defined geographic territory in accordance with a schedule of dates. The development schedule generally covers two to five years and typically has store operation benchmarks for the number of stores to be open and in operation at six-month intervals. Area developers currently pay a nonrefundable development fee of $5,000 per store to be developed and make a deposit of $5,000 per store to be developed toward the store's initial franchise fee (discussed below). Failure to meet development schedules or other breaches of the area development agreement may lead to termination of the exclusivity provided by the agreement.

Franchise Agreements Once the company and the area developer execute an acceptable lease for an approved store site, they enter into a franchise agreement under which the area developer becomes the franchisee for the specific store to be developed at the site. The company assists the area developer with site selection and construction coordination, for which it receives a real estate fee. Current franchise agreements typically provide for payment of a $35,000-per-store initial franchise fee (less the $5,000 deposit), a 5 percent royalty on gross store revenue, and a $10,000 minimum grand-opening expenditure. In addition, ihc franchise agreement provides that the company may specify computer software for use in the stores; the franchisee pays an upfront Hcense fee plus an ongoing maintenance fee for this software. Integrated hardware and software permit the company to closely monitor the operations of each store as well as communicate new developments. The company may own a particular store's equipment, for which it receives periodic lease revenue from franchisees.

Area Developer Financing The company believes that the development and operation of stores in a targeted market is enhanced when the area developer does not have to spend time raising capital. Accordingly, the company extends secured debt financing to area developers to partially finance store development and working capital needs in maximum amounts equal to three to four times the area developer's paidin capital. As of the end of Year 15, the company had agreements to provide secured financing to 17 of its area developers. Such commitments aggregated $62 1 .5 million, of which $471.0 million was outstanding. The company's loan agreement with its area developers generally requires the area developer to expend at least 75 percent of its contributed capital toward developing stores before drawing on its revolving loan.

The draw period is approximately two to three years. On expiration of the draw period, the loan converts to an amortizing term loan payable over four to five years in periodic installments, generally with a final balloon payment. The bonower pays interest each period at a rate set at 1 percent over the applicable "reference rate" of the Bank of America Illinois as established from time to time. A pledge of substantially all of the assets of the area developer secures the loan. Some loans have a conversion feature in which the company may convert unpaid amounts of the loan into an equity interest in the area developer. The company can exercise the conversion feature only after a moratorium period has elapsed (generally two years after execution of the loan) or after the area developer defaults on the loan. The conversion price is set at a 12 percent to 15 percent premium over the per-unit equity price paid by the area developer for its equity interest in the area development entity.

Marketing The company markets through television, radio, newspapers, and other print media, direct mail, and in-store point-of-purchase displays. Franchisees pay a national advertising fee of 2 percent of gross store revenues and a local advertising fee of 4 percent of gross store revenues.

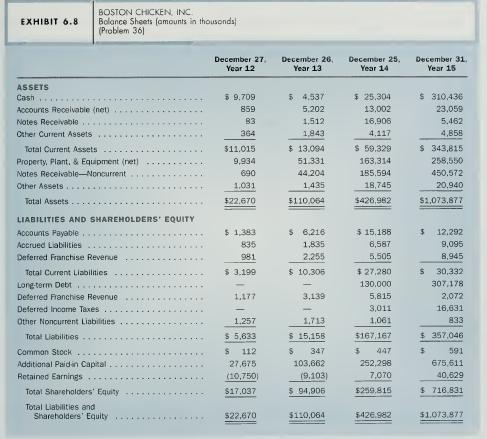

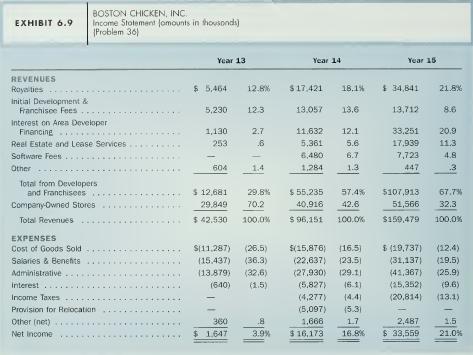

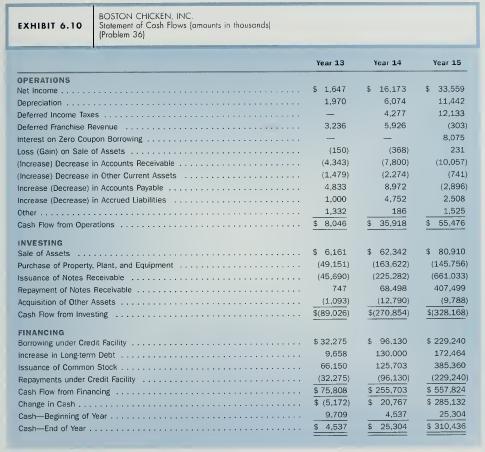

Financial Statements and Notes Exhibit 6.8 presents balance sheets. Exhibit 6.9 presents income statements, and Exhibit 6.10 presents statements of cash flows for Boston Chicken, Inc., for the Yeiu' 13 through Year 15 fiscal years. Selected notes to these financial statements appear below.

Revenue Recognition Revenue from company-operated stores is recognized in the period for which related food and beverage products are sold. Royalties are recognized in the same period in which related franchise store revenue is generated.

Revenue derived from initial franchise fees and area development fees is recognized when the franchise store opens. Interest, real estate services, and software maintenance fees are recognized as earned. Lease income is recognized over the life of the lease on a straight-line basis. Software license income is recognized as the software is placed in service.

Accounts Receivable Accounts receivable includes amounts currently due from area developers and franchisees other than for loans (see discussion of notes receivable, below). The amounts appearing in Exhibit 6.8 are net of an allowance for un-

collectible accounts of $77,000 on December 27. Year 12. $323,000 on December 26. Year 13, $246,000 on December 25. Year 14, and $1.043.000 on December 31, Year 15. Bad debt expense was $321.000 for Year 13, S187,000 for Year 14, and $797.000 for Year 15. Notes Receivable Notes receivable include amounts payable by area developers and franchisees under multiyear lending arrangements (see discussion of area devel- oper financing, above). The company maintains an allowance for loan losses at a level that in management's judgment is adequate to provide for estimated possible loan losses. The company bases the amount of the allowance on management's re- view of each area developer's use of loan proceeds, adherence to its store develop- ment schedule, store performance trends, type and amount of collateral securing the loan, prevailing economic conditions, and other factors that management deems

relevant at the time. Based on this review and analysis, no allowance was required at the end of the Year 12. Year 13, Year 14. or Year 15 fiscal year. National and Local Advertising Funds The company administers a National Advertising Fund, to which company-operated stores and franchisees make con- tributions based on individual franchise agreements (generally 2 percent of store revenues). Collected amounts are spent primarily on developing marketing and advertising materials for use systemwide. The National Advertising Fund is ac- counted for separately and is not included in the financial statements of the company. The company also maintains Local Advertising Funds, which provide comprehensive advertising and sales promotion support for the Boston Market stores in particular markets. Periodic contributions by company-owned stores and franchisees (generally 4 percent of store revenues) finance local advertising and promotion expenditures. The Local Advertising Funds are accounted for separately and are not included in the financial statements of the company. Actual expenditures on national and local ad- vertising as of December 31, Year 15. have exceeded the amounts collected from franchisees by $9.6 million. The company includes this excess amount in accounts receivable on its balance sheet. Related Party Transactions The company and certain area developers have en- tered into secured loan and area development agreements in which certain directors

and certain currem and former officers of the company and members of their families have a direct or indirect equity interest. The company has received from these enti- ties in Year 13. Year 14, and Year 15 approximately $6.6 million. $30.9 million, and $46.0 million, respectively, in development. franchise, royalty, software license, soft- ware maintenance. accounting and other miscellaneous fees, rent. and interest on their loans with the company. In addition, these entities have paid approximately $3.5 million. $11.3 million, and $20.0 million in national and local advertising contribu tions during the same periods. The company has also sold to certain of these entities Boston Market stores, inventory, equipment, and other miscellaneous assets, includ- ing reimbursement of the company's general and administrative costs and expenses of operating the stores, for which it received $5.0 million, $47.1 million, and $14.61 million in Year 13. Year 14. and Year 15. respectively. The company believes that the terms of these agreements are as favorable to the company as are those of agreements with other area developers. The company has paid to one of these area developers $146,000 in Year 14 and $100,000 in Year 15 for various services. During Year 13.

the company's chief executive officer received from the company $107,066 as reimbursement for payments he made to Bowana Aviation, Inc., for the company's use of an aircraft owned by Bowana. During Year 14 and Year 15, the company paid $527,744 and $661,960, respectively, to Bowana for the use of aircraft. The company's chief executive officer and a relative own Bowana. The company believes that the amounts charged are at rates comparable to those charged by third parties.

Relocation In September Year 14, the company consolidated its four Chicagobased support-center facilities into a single facility and relocated to Golden, Colorado.

The cost of the relocation, including moving personnel and facilities, making severance payments, and writing off vacated leasehold improvements, was $5.1 million.

a. Discuss the appropriateness of the timing of revenue recognition by Boston Chicken for each of the following:

(1) Development franchise fee (2) Initial franchise fee (3) Royalties (4) Interest on loans to area developers (5) Real estate service and leasing fees (6) Software license and maintenance fees (Hint: Analyze the changes in the allowance for uncollectible accounts for Year 13, Year 14, and Year 15 to assess the collectibility of outstanding accounts and notes receivable.)

b. Suggest possible reasons why Boston Chicken might choose to develop and operate its stores through nonowned area developers and franchisees instead of through outright ownership.

c. Suggest possible reasons why Boston Chicken might choose to structure its marketing activities using the National Advertising Fund and the Local Advertising Funds.

d. Exhibit 6.11 presents selected operating data and financial statement ratios for Boston Chicken (in addition to the common-size income statement in Exhibit 6.9). Analyze the changes in the profitability and risk of Boston Chicken between Year 13 and Year 15.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil