Income recognition for a contractor. On March 15. Year 1. Clinton Construction Company contracted to build a

Question:

Income recognition for a contractor. On March 15. Year 1. Clinton Construction Company contracted to build a shopping center at a contract price of $120 million.

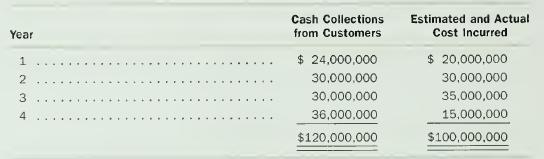

The schedule of expected and actual cash collections and contract costs is as follows:

a. Calculate the amount of revenue, expense, and net income for each of the four years under the following revenue recognition methods:

(1) Percentage-of-completion method (2) Completed contract method (3) Installment method (4) Cost-recovery-first method

b. Which method do you believe provides the best measure of Clinton Construction Company's performance under the contract? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil

Question Posted: