Assume that Federal Department Stores. Incorporated, is about to sign four separate leases for stores in four

Question:

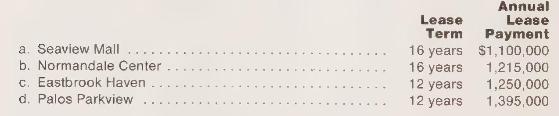

Assume that Federal Department Stores. Incorporated, is about to sign four separate leases for stores in four separate shopping centers. Each of the stores would cost \(\$ 10\) million if purchased outright and has an economic life of 20 years. Assume that the company currently must pay interest at the rate of 10 percent per year on long-term, secured borrowing. The lease payments are to be made at the end of each year in all four cases.

Based on the information given here, decide whether each of the four leases requires accounting as operating leases or as capital leases. Give your reasoning.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney

Question Posted: