What is the amount of Gain or Loss recognized on the disposition? Enter a Gain as a positive number or a Loss as a negative

What is the amount of Gain or Loss recognized on the disposition? Enter a Gain as a positive number or a Loss as a negative number or Zero if neither is recognized.

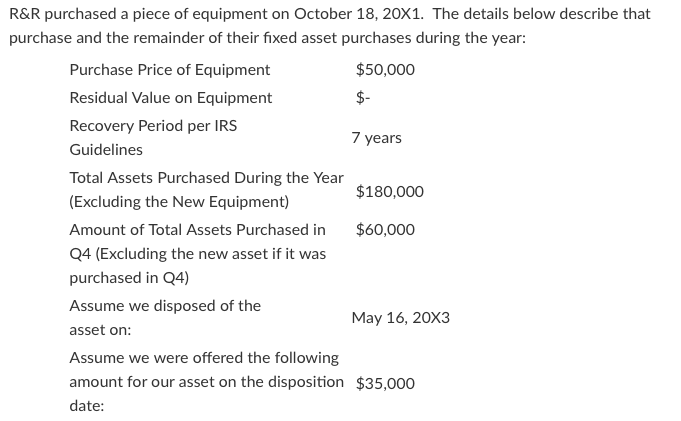

R&R purchased a piece of equipment on October 18, 20X1. The details below describe that purchase and the remainder of their fixed asset purchases during the year: Purchase Price of Equipment Residual Value on Equipment Recovery Period per IRS Guidelines Total Assets Purchased During the Year $50,000 $- 7 years $180,000 (Excluding the New Equipment) Amount of Total Assets Purchased in $60,000 Q4 (Excluding the new asset if it was purchased in Q4) Assume we disposed of the asset on: Assume we were offered the following May 16, 20X3 amount for our asset on the disposition $35,000 date:

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided in the imageit is possible to calculate the gain or loss on the disposition of the equipment Given Purchase price of equipment50000 Residual value on equipment0 assum...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started