At the beginning of September 2012, GL had the following balances on the accounts of three customers:

Question:

At the beginning of September 2012, GL had the following balances on the accounts of three customers:

A. Barton £400

C. Dodd £1,200

F. Gray £340

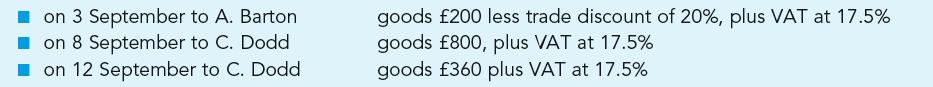

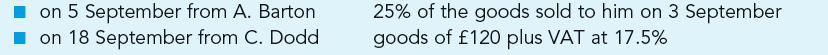

During September, the following sales and returns took place for the above customers:

Sales

Sales returns

The balance at the bank was £347 overdrawn on 1 September 2012.

The following bank transactions took place during September 2012:

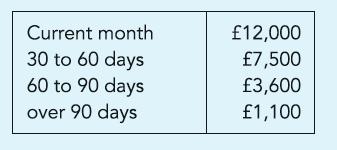

GL has a computerised Trade Receivable Ledger system which produced an aged trade receivables printout as at 30 September 2012 as shown.

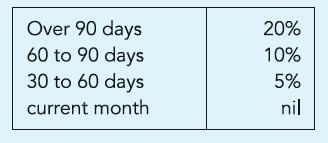

The balance on the Allowance for doubtful debts account at 1 September 2012 was £450 credit. No further allowance for doubtful debts has been made since then.

(i) The ‘Current month’ total includes £60 for discounts allowed to debtors not recorded in the Sales ledger.

(ii) The ’30 to 60 day’ total includes a balance of £200 to be taken as a contra entry in the Purchase ledger.

(iii) The ‘over 90 days’ total includes a trade receivable of £240 to be written off as bad debt.

(iv) The company has decided to amend the Allowance for doubtful debts to the amounts stated.

Required:

(a) Write up a Cash Book for September 2012, with columns for Bank and Cash discount, and balance off at 30 September 2012. You are not required to complete the double-entry except where asked to do so in part (b) below.

(b) Write up the ledger accounts (in date order) for A. Barton, C. Dodd and F. Gray.

(c) Calculate the change in the Allowance for doubtful debts.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict