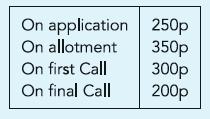

Bravo plc invited application for 10,000 ordinary shares of 10 each, payable as stated in the box

Question:

Bravo plc invited application for 10,000 ordinary shares of £10 each, payable as stated in the box on the right. By 31 January 2010 applications were received for 16,000 shares. Applications for 4,000 shares, from non-residents, were rejected and application money refunded. On 1 February allotment was made pro rata to other applicants, excess received on application being retained against amounts due on allotment. The first call was made on 1 April 2010. By 30 June 2010:

(a) All amounts receivable on allotment had been received except for the amount due on 1,000 shares that had been allotted.

(b) All amounts receivable on the first call had been received except for the amount due on 500 shares.

(c) The amount due on the final call had been received in advance from those to whom 1,200 shares had been allotted.

Required:

(a) Identify the amount reported in the Share capital account and explain what that amount represents.

(b) Explain the concept of share premium and what a company may apply it for.

(c) Set out the Application and allotment account, First call account, the Share capital account, the Share premium account and the Calls received in advance account, up to 30 June 2010.

(d) Show how the amounts received and receivable will be reported on the company’s Statement of financial position as at 30 June 2010.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict