Calculating and interpreting profitability and risk ratios. Wal-Mart Stores, Inc., is the largest retailing company in the

Question:

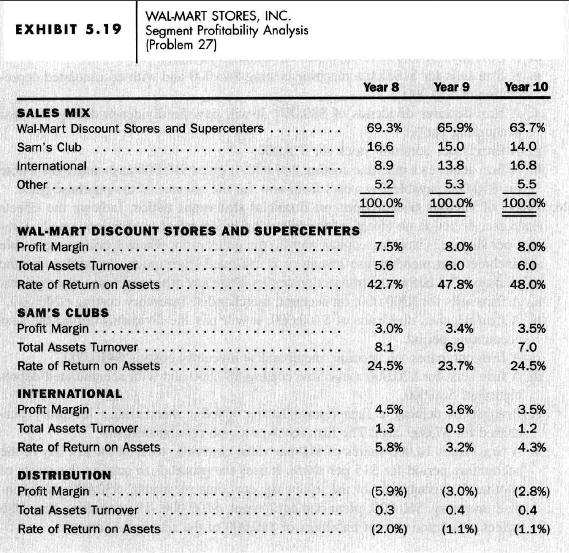

Calculating and interpreting profitability and risk ratios. Wal-Mart Stores, Inc., is the largest retailing company in the world. It maintains chains of discount stores and warehouse clubs in many parts of the United States. In recent years, it has expanded operations into superstores that offer a combination of traditional discount store products and grocery products. It has also expanded internationally by acquiring established discount chains in other countries. As an extension of warehousing and distributing products for its own stores, it offers similar services to other retail stores. Exhibit 5.19 presents segment profitability ratios, Exhibit 5.20 presents a comparative balance sheet, Exhibit 5.21 presents a comparative income statement, and Exhibit 5.22 presents a comparative statement of cash flows for Wal-Mart Stores for three recent years. Exhibit 5.23 presents a financial statement ratio analysis for WalMart Stores for Year 8 and Year 9. The income tax rate is 35 percent.

a. Compute the amounts of the ratios listed in Exhibit 5.23 for Year 10 .

b. What are the likely reasons for the changes in Wal-Mart's rate of return on assets during the three-year period? Analyze the financial ratios to the maximum depth possible.

c. What are the likely reasons for the changes in Wal-Mart's rate of return on common shareholders' equity during the three-year period?

d. How has the short-term liquidity risk of Wal-Mart changed during the three-year period?

e. How has the long-term liquidity risk of Wal-Mart changed during the three-year period?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil