Choosing between investment alternatives. (Adapted from a problem by S. Zeff.) William Marsh, CEO of Gulf Coast

Question:

Choosing between investment alternatives. (Adapted from a problem by S. Zeff.)

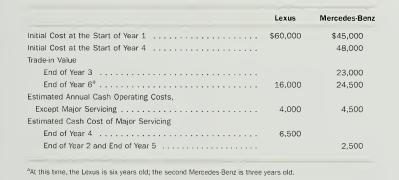

William Marsh, CEO of Gulf Coast Manufacturing, wants to know which of two strategies he has chosen for acquiring an automobile has the lower present value of cost.

Strategy L. Acquire a new Lexus, keep it for six years, then trade it in on a new car.

Strategy M. Acquire a new Mercedes-Benz, trade it in after three years on a second Mercedes-Benz, keep that for another three years, then trade it in on a new car.

Data pertinent to these choices appear below. Assume that Marsh will receive the trade-in value in cash or as a credit toward the purchase price of a new car. Ignore income taxes, and use a discount rate of 10 percent per year. Gulf Coast Manufacturing depreciates automobiles on a straight-line basis over 8 years for financial reporting, assuming zero salvage value at the end of 8 years.

a. Which strategy has the lower present value of costs?

b. What role, if any, do depreciation charges play in the analysis and why?

(Appendix)

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil