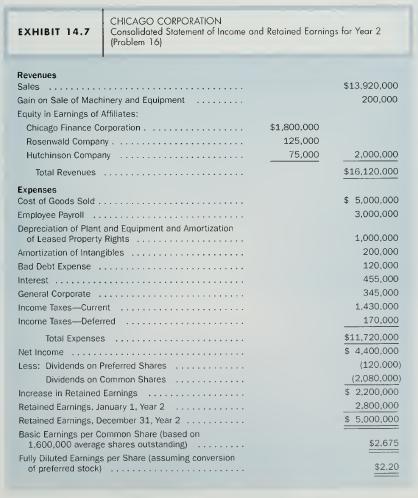

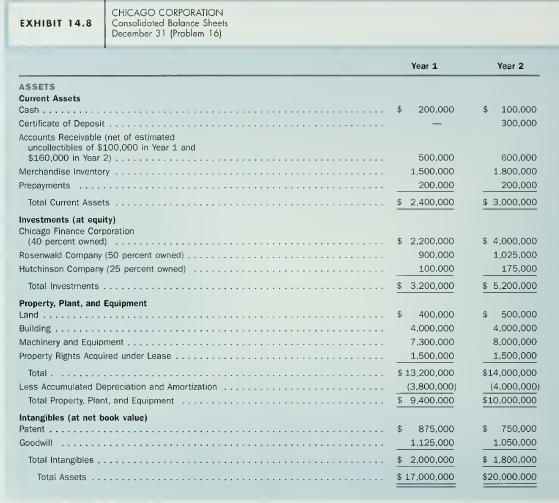

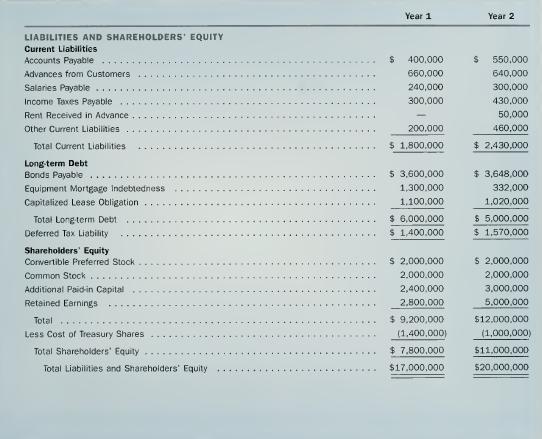

Comprehensive review problem. Exhibits 14.7 and 14.8 present a partial set of financial statements of Chicago Corporation

Question:

Comprehensive review problem. Exhibits 14.7 and 14.8 present a partial set of financial statements of Chicago Corporation for Year 2, including a consolidated statement of income and retained earnings for Year 2 and consolidated comparative balance sheets at December 3 1 , Year 1 and Year 2. A series of questions relating to the financial statements of Chicago Corporation follows these financial statements.

You should study the financial statements before responding to these questions and problems. Additional information is as follows:

(1) During Year 2, Chicago Corporation sold, for cash, machinery and equipment costing $1,000,000 and with a book value of $200,000.

(2) The only transaction affecting common or prefened stocks during Year 2 was the sale of treasury stock.

(3) The bonds payable have a maturity value of $4 million.

a. Compute the amount of specific customers' accounts that Chicago Corporation wrote off as uncollectible during Year 2, assuming that it made no recoveries during Year 2 on accounts written off in years prior to Year 2.

b. Chicago Corporation uses the LIFO cost flow assumption in computing its cost of goods sold and its beginning and ending merchandise inventory amounts. If it had used a FIFO cost flow assumption, the beginning inventory would have been $1,800,000 and the ending inventory would have been $1,700,000. Compute the actual gross profit (net sales less cost of goods sold)

of Chicago Corporation for Year 2 under LIFO and the corresponding amount of gross profit if FIFO had been used (ignore income tax effects). Chicago Corporation used the periodic inventory method.

c. Refer to part h. Did the quantity and acquisition costs of merchandise inventory increase or decrease between the beginning and the end of Year 2? Explain.

d. Chicago Corporation accounts for its three intercorporate investments in un- consolidated affiliates using the equity method. It acquired the shares in each of these companies at book value at the time of acquisition. How much did each of these three companies declare in dividends during Year 2? How can you tell?

e. Chicago Corporation accounts for its three intercorporate investments in un- consolidated affiliates using the equity method. It acquired the shares in each

of these companies at book value at the time of acquisition. Give the journal entry (entries) made during Year 2 to apply the equity method.

f. Chicago Corporation acquired its only building on January 1. Year 1. It estimated the building to have a 40-year useful life and zero salvage value at that time. Calculate the amount of depreciation expen.se on this building for Year 2, assuming that the firm uses the double declining-balance method.

g. Chicago Corporation sold machinery and equipment costing Sl.OOO.OOO. with a book value of $200.0(J0. for cash during Year 2. Give the journal entry to record the disposition.

h. The bonds payable cairy 6 percent annual coupons and require the payment of interest on December 31 of each year. Give the journal entry made on December 31, Year 2. to recognize interest expense for Year 2. assuming lliat Chicago Corporation uses tiie effective interest method.

i. Refer to part h. What was the effective or market interest rate on these bonds on the date they were issued? Explain.

j. The $170,000 deferred portion of income tax expense for Year 2 includes $150,000 relating to the use of different depreciation methods for financial and tax reporting. If the income tax rate was 30 percent, calculate the difference between the depreciation deduction reported on the tax return and the depreciation expense repoiled on the income statement.

k. Give the journal entry that explains the change in the treasury shares account assuming that no other transactions affected the common or preferred shares during Year 2.

1. If the original acquisition cost of the patent is $1,250,000, and the firm amortizes the patent on a straight-line basis, how long before December 31, Year 2, did the firm acquire the patent?

ni. Chicago Corporation acquired the stock of Hutchinson Company on December 31, Year 1. If it held the same amount of stock during the year, but the amount represented only a 15 percent ownership of the Hutchinson Company, how would the financial statements have differed? Disregard income tax effects, and assume the market price of the shares exceeds their acquisition cost by $25,000 on December 3 1 , Year 2.

n. During Year 2, Chicago Corporation paid $170,000 to the lessor of property represented on the balance sheet by "Property Rights Acquired under Lease."

Property rights acquired under lease have a 10-year life, and Chicago Corporation amortizes them on a straight-line basis. What was the total expense reported by Chicago Corporation during Year 2 from using the leased property?

o. How would the financial statements differ if Chicago Corporation accounted for inventories on the lower-of-cost-or-market basis and if the market value of these inventories had been $1,600,000 at the end of Year 2? Disregard income tax effects.

p. Refer to the earnings-per-share amounts in the income statement of Chicago Corporation. How many shares of common stock would the firm issue if holders of the outstanding shares of preferred stock converted them into common stock?

q. Prepare a T-account work sheet for a statement of cash flows for Chicago Corporation for Year 2. The certificate of deposit is a cash equivalent.

r. The treasurer of Chicago Corporation recently remarked, "The value or worth of our coinpany on December 31, Year 2, is $1 1,000,000, as measured by total shareholders" equity." Describe briefly at least three reasons why the difference between recorded total assets and recorded total liabilities on the balance sheet does not represent the firm's value or worth, s. Some financial statement users criticize the accounting profession for permitting several GAAP for the same or similar transactions. What are the major arguments for ( 1 ) narrowing the range of acceptable methods or (2) continuing the present system of permitting business firms some degree of flexibility in selecting their accounting methods?(Appendix)

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil