Computations and journal entries for income taxes with both temporary and permanent differences. Sung Company reported the

Question:

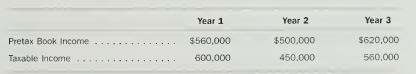

Computations and journal entries for income taxes with both temporary and permanent differences. Sung Company reported the following amounts for book and tax purposes for its first three years of operations:

The differences between book income and taxable income result from different de- preciation methods. The income tax rate was 40 percent during all years.

a. Give the journal entry to record income tax expense for each year.

b. Assume for this part that the firm included $10,000 of interest on state and mu- nicipal honds in the pretax book income amounts shown above for each year but properly excluded these amounts from taxable income. Give the journal entry to record income tax expense for each year.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil