? Fisheries Bhd is a small listed company involves in fishing and selling fish to the public via retail outlets. The company owns a building

?

?

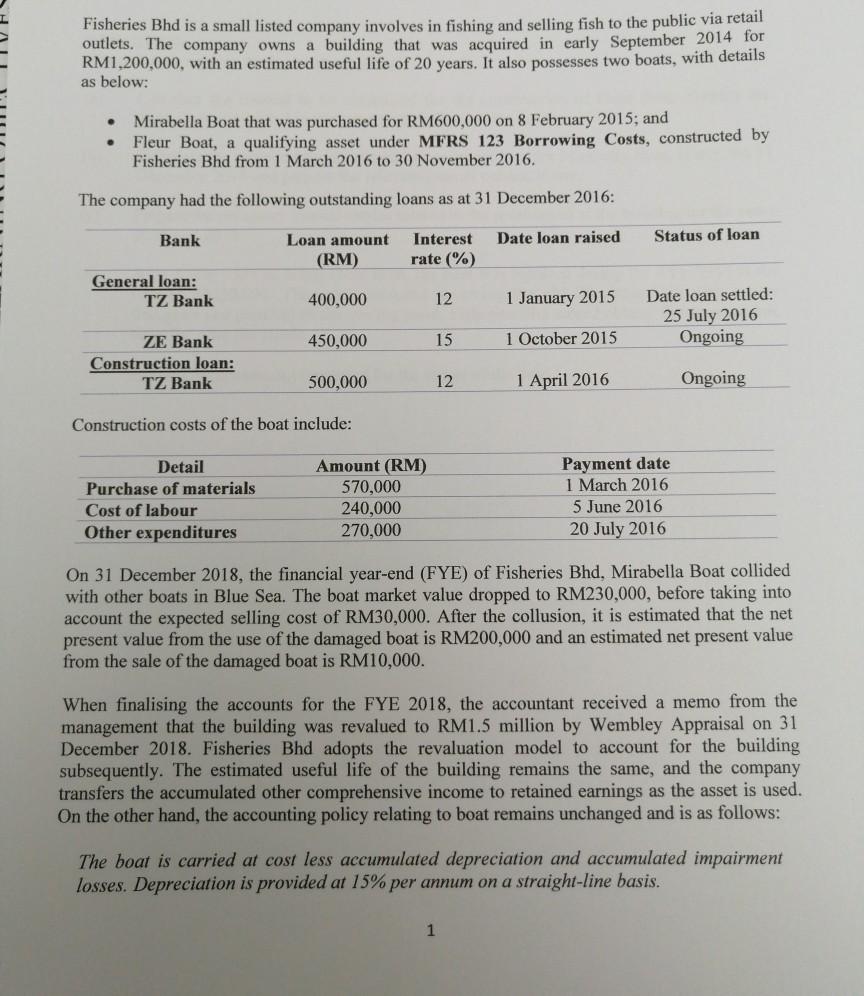

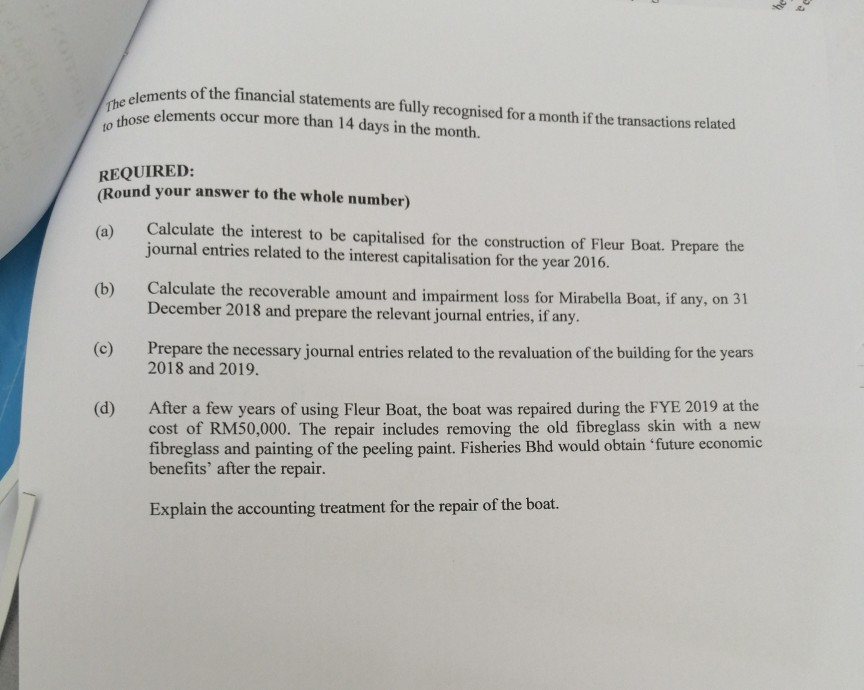

Fisheries Bhd is a small listed company involves in fishing and selling fish to the public via retail outlets. The company owns a building that was acquired in early September 2014 for RM1,200,000, with an estimated useful life of 20 years. It also possesses two boats, with details as below: Mirabella Boat that was purchased for RM600,000 on 8 February 2015; and Fleur Boat, a qualifying asset under MFRS 123 Borrowing Costs, constructed by Fisheries Bhd from 1 March 2016 to 30 November 2016. The company had the following outstanding loans as at 31 December 2016: Interest rate (%) Bank General loan: TZ Bank ZE Bank Construction loan: TZ Bank Loan amount (RM) 400,000 Detail Purchase of materials Cost of labour Other expenditures 450,000 500,000 Construction costs of the boat include: Amount (RM) 570,000 240,000 270,000 12 15 12 Date loan raised 1 January 2015 1 October 2015 1 April 2016 Status of loan 1 Date loan settled: 25 July 2016 Ongoing Ongoing Payment date 1 March 2016 5 June 2016 20 July 2016 On 31 December 2018, the financial year-end (FYE) of Fisheries Bhd, Mirabella Boat collided with other boats in Blue Sea. The boat market value dropped to RM230,000, before taking into account the expected selling cost of RM30,000. After the collusion, it is estimated that the net present value from the use of the damaged boat is RM200,000 and an estimated net present value from the sale of the damaged boat is RM10,000. When finalising the accounts for the FYE 2018, the accountant received a memo from the management that the building was revalued to RM1.5 million by Wembley Appraisal on 31 December 2018. Fisheries Bhd adopts the revaluation model to account for the building subsequently. The estimated useful life of the building remains the same, and the company transfers the accumulated other comprehensive income to retained earnings as the asset is used. On the other hand, the accounting policy relating to boat remains unchanged and is as follows: The boat is carried at cost less accumulated depreciation and accumulated impairment losses. Depreciation is provided at 15% per annum on a straight-line basis. The elements of the financial statements are fully recognised for a month if the transactions related to those elements occur more than 14 days in the month. REQUIRED: (Round your answer to the whole number) (a) (b) (d) Calculate the interest to be capitalised for the construction of Fleur Boat. Prepare the journal entries related to the interest capitalisation for the year 2016. Calculate the recoverable amount and impairment loss for Mirabella Boat, if any, on 31 December 2018 and prepare the relevant journal entries, if any. Prepare the necessary journal entries related to the revaluation of the building for the years 2018 and 2019. After a few years of using Fleur Boat, the boat was repaired during the FYE 2019 at the cost of RM50,000. The repair includes removing the old fibreglass skin with a new fibreglass and painting of the peeling paint. Fisheries Bhd would obtain future economic benefits' after the repair. Explain the accounting treatment for the repair of the boat. -24 Pa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Fisheries Bhd a Calculation of interest to be capitalised for the construction of Fleur BoatBorrowing costRM 50000012812RM 40000note8 Monthsp... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards