Computing the amount of impairment loss. Tillis Corporation acquired the assets of Kieran Corporation (Kieran) on January

Question:

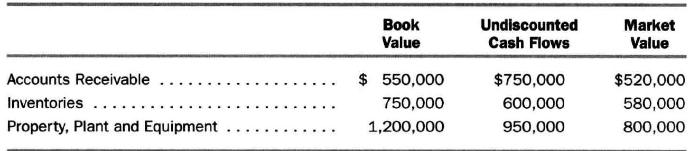

Computing the amount of impairment loss. Tillis Corporation acquired the assets of Kieran Corporation (Kieran) on January 1, Year 6 for $\$ 2,400,000$. On this date, the market values of the assets of Kieran were as follows: accounts receivable, $\$ 400,000$; inventories, $\$ 600,000$; property, plant and equipment, $\$ 900,000$. On June 15, Year 8, a competitor introduced a new product that will likely significantly affect future sales of Kieran's products. It will also affect the value of Kieran's property, plant, and equipment because of their specialized nature in producing Kieran's existing products. The following information relates to the assets of Kieran on June 15, Year 8:

The market value of Kieran as an entity on June 15 , Year 8 , is $\$ 2,200,000$.

Compute the amount of impairment loss recognized on each of Kieran's assets on June 15, Year 8 .

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil