Journal entries to correct accounting errors. Give correcting entries for the following situations. In each case, the

Question:

Journal entries to correct accounting errors. Give correcting entries for the following situations. In each case, the firm uses the straight-line method of depreciation and closes its books annually on December 31. Recognize all gains and losses currently.

a. A firm purchased a computer for $\$ 3,000$ on January 1, Year 3. It depreciated the computer at a rate of 25 percent of acquisition cost per year. On June 30, Year 5, it sold the computer for $\$ 800$ and acquired a new computer for $\$ 4,000$. The bookkeeper made the following entry to record the transaction:

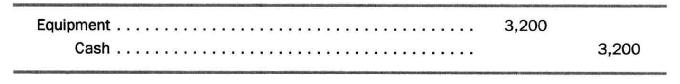

b. A firm purchased a used truck for $\$ 7,000$. Its cost, when new, was $\$ 12,000$. The bookkeeper made the following entry to record the purchase:

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil