Cost of self-constructed assets. Assume that Bolton Company purchased a plot of land for $$ 90,000$ as

Question:

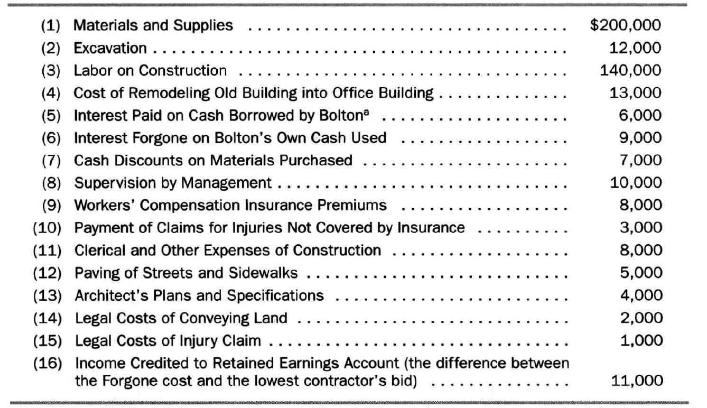

Cost of self-constructed assets. Assume that Bolton Company purchased a plot of land for $\$ 90,000$ as a factory site. A small office building sits on the plot, conservatively appraised at $\$ 20,000$. The company plans to use the office building after making some modifications and renovations. The company had plans drawn for a factory and received bids for its construction. It rejected all bids and decided to construct the factory itself. Management believes that plant asset accounts should include the following additional items:

Show in detail the items Bolton should include in the following accounts: Land, Factory Building, Office Building, and Site Improvements. Explain the reason for excluding any of these items from the four accounts.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil