Dealing with LIFO inventory layers. (Adapted from a problem by S. A. Zeff.) The Back Store has

Question:

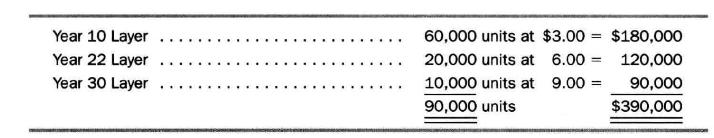

Dealing with LIFO inventory layers. (Adapted from a problem by S. A. Zeff.) The Back Store has been using a LIFO cost flow assumption for several decades. On December 31, Year 30, the company's inventory comprised the following layers:

During Year 30 , the company had bought 200,000 units at \(\$ 9\) each. At the end of the year, the replacement cost of units was \(\$ 8\). During Year 31 , the company bought 250,000 units at \(\$ 10\) per unit, which was the average replacement cost of units for the entire year. The company sold 300,000 units at \(\$ 15\) each during Year 31. At the end of the year, the replacement cost of units was \(\$ 11\).

a. How many units did the company sell during Year 30?

b. What was the operating margin on sales, that is, the replacement cost gross margin, for Year 31?

c. What was the gross margin conventionally reported for Year 31 assuming LIFO?

d. What was the economic profit, that is, realized margin plus all holding gains, for Year 31 ?

e. If the company had used FIFO for both Year 30 and Year 31, what would have been the conventionally reported gross margin for Year 31?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil