Reconstructing underlying events from ending inventory amounts. (Adapted from CPA examination.) Burch Corporation began a merchandising business

Question:

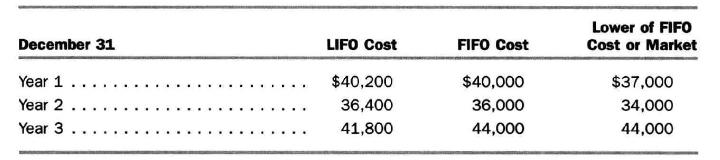

Reconstructing underlying events from ending inventory amounts. (Adapted from CPA examination.) Burch Corporation began a merchandising business on January 1, Year 1. It acquired merchandise costing \(\$ 100,000\) in Year 1, \(\$ 125,000\) in Year 2, and \(\$ 135,000\) in Year 3. Information about Burch Corporation's inventory as it would appear on the balance sheet under different inventory methods appears below:

In answering each of the following questions, indicate how you deduced the answer. You may assume that in any one year, prices moved only up or down but not both.

a. Did prices go up or down in Year 1?

b. Did prices go up or down in Year 3?

c. Which inventory method would show the highest income for Year 1?

d. Which inventory method would show the highest income for Year 2?

e. Which inventory method would show the highest income for Year 3?

f. Which inventory method would show the lowest income for all three years considered as a single period?

g. For Year 3, how much higher or lower would income be on the FIFO cost basis than on the lower-of-cost-or-market basis?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil