The purpose of this problem is to help you understand how to compare income as it appears

Question:

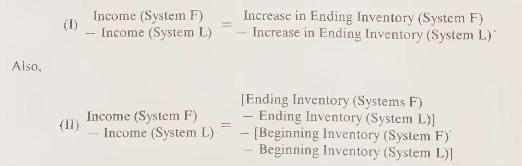

The purpose of this problem is to help you understand how to compare income as it appears in financial statements under a given cost-flow assumption (or other inventory system) with what income would have been under a different cost-flow assumption (or other inventory system). The following two relations can help. In comparing income under one set of conditions, called system \(\mathrm{F}\), with income under another set of conditions, called system \(\mathrm{L}\),

We use the symbols F and \(L\) to evoke the thoughts FIFO and LIFO as you read these equations. but keep in mind that the equations hold whatever comparisons are being made. For example condition F might represent a specific identification method of measuring cost of goods sold. whereas \(\mathrm{L}\) might represent a weighted-average cost-flow assumption with a perpetual inventory method.

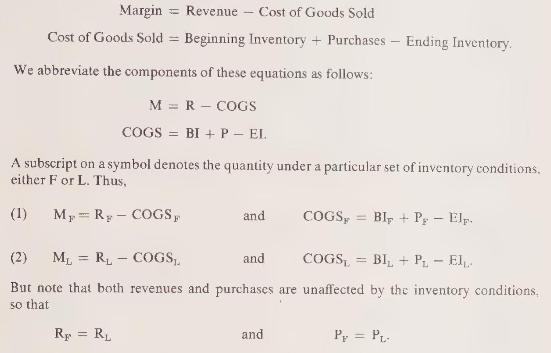

Some readers will prefer to see a derivation of these results. We use the following two equations:

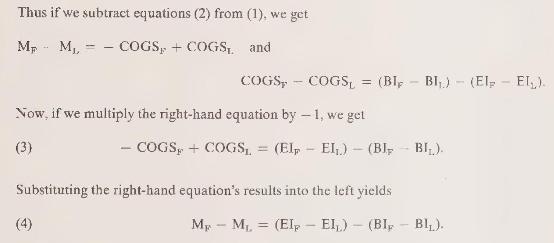

Equation (4) is the second relation mentioned above (II) as being useful in comparing inventory conditions. The first term in parentheses on the right-hand side is the difference between ending inventories, and the second is the difference between beginning inventories. If we rearrange the terms on the right-hand side of equation (4), we get

![]()

The right-hand side of (5) is the increase in inventory during the year under conditions \(F\) minus the increase in inventory during the period under conditions \(L\). Thus, equation (5)

is the first relation (I) mentioned above as being useful in comparing incomes under two sets of inventory conditions.

Exhibit 8.2 illustrates this relation. For example, the difference between FIFO and LIFO income (or gross margins) is \(\$ 5(=\$ 30-\$ 25)\). The difference between the FIFO and LIFO increases in inventory during the period is also \(\$ 5\) (=\$34-\$29). This relation can also be seen in Exhibit 8.2 by comparing FIFO and weighted-average income differences (\$3) or weighted-average and LIFO differences (\$2).

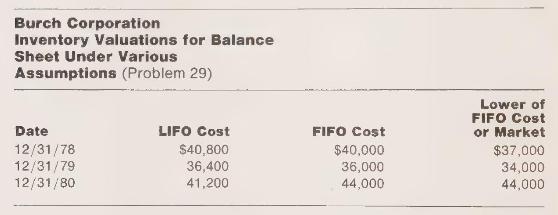

The Burch Corporation began a merchandising business on January 1, 1978. It acquired merchandise costing \(\$ 100,000\) in \(1978, \$ 125,000\) in 1979, and \(\$ 135,000\) in 1980. Information about Burch Corporation's inventory, as it would appear on the balance sheet under different inventory methods, is shown below:

In answering each of the following questions, indicate how the answer is deduced. You may assume that in any one year, prices moved only up or down, but not both in the same year.

a Did prices go up or down in 1978?

b Did prices go up or down in 1980?

c Which inventory method would show the highest income for 1978 ?

d Which inventory method would show the highest income for 1980 ?

e Which inventory method would show the highest income for 1979?

f Which inventory method would show the lowest income for all three years combined?

g For 1980, how much higher or lower would income be on the FIFO cost basis than it would be on the lower-of-cost-or-market basis?

h The notes to the financial statements in a recent annual report of the Westinghouse Electric Corporation contain the following statement. "The excess of current cost [of inventories] . . . over the cost of inventories valued on the LIFO basis was \(\$ 230\) million at [year-end] and \(\$ 163\) million at [the beginning of the year]." How much higher or lower would Westinghouse's pretax reported income have been if its inventories had been valued at current costs, rather than with a LIFO cost-flow assumption? Westinghouse reported \(\$ 28\) million net income for the year and tax expense equal to 48 percent of pretax income. By what percentage would Westinghouse's net income increase if a FIFO flow assumption had been used?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney