The Wilson Company sells chemical compounds made from expensium. The company has used a LIFO inventory-flow assumption

Question:

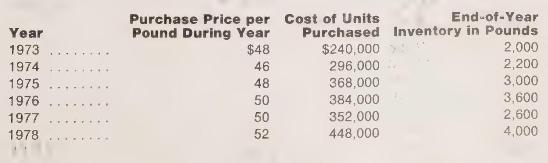

The Wilson Company sells chemical compounds made from expensium. The company has used a LIFO inventory-flow assumption for many years. The inventory of expensium on January 1,1973 , consisted of 2,000 pounds from the inventory bought in 1969 for \(\$ 30\) a pound. The following schedule shows purchases and physical ending inventories of expensium for the years 1973 through 1978

Because of temporary scarcities, expensium is expected to cost \(\$ 62\) per pound during 1979 but to fall back to \(\$ 52\) per pound in 1980 . Sales for 1979 are expected to require 7,000 pounds of expensium. The purchasing agent suggests that the inventory of expensium be allowed to decrease from 4,000 to 600 pounds by the end of 1979 and to be replenished to the desired level of 4,000 pounds early in 1980 .

The controller argues that such a policy would be foolish. If inventories are allowed to decrease to 600 pounds, then the cost of goods sold will be extraordinarily low (because the older LIFO purchases will be consumed) and income taxes will be extraordinarily high. Furthermore, he points out that the diseconomies of smaller orders during 1979, as required by the purchasing agent's p!an, would lead to about \(\$ 1.000\) of extra costs for recordkeeping. These costs would be treated as an expense for 1979. He suggests that 1979 purchases should be planned to maintain an end-of-year inventory.

Assume that sales for 1979 do require 7,000 pounds of expensium, that the prices for 1979 and 1980 are as forecast, and that the income tax rate for Wilson Company is 40 percent.

Calculate the cost of goods sold and end-of-year LIFO inventory:

a For each of the years 1973 through 1978.

b For 1979, assuming that the controller's advice is followed so that inventory at the end of 1979 is 4,000 pounds.

c For 1979, assuming that the purchasing agent's advice is followed and inventory at the end of 1979 is 600 pounds.

Assuming that the controller's, rather than the purchasing agent's, advice is followed, calculate:

d The tax savings for 1979 .

e The extra cash costs for inventory.

f Using the results derived so far, what should Wilson Company do?

g Would your advice be different if Wilson Company used a FIFO cost-flow assumption?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney