During the year the company acquired non-current assets for 1,900,000 and sold for 80,000 ones written down

Question:

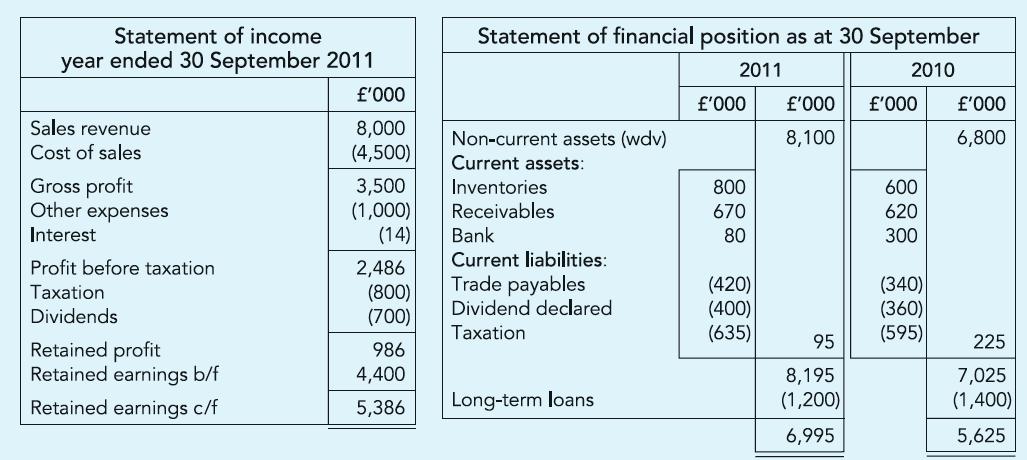

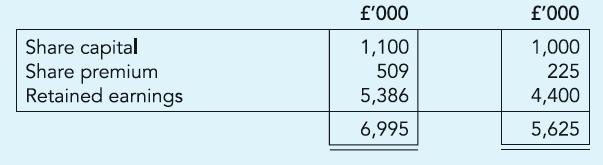

During the year the company acquired non-current assets for £1,900,000 and sold for £80,000 ones written down to £310,000.

Required: Prepare a Statement of cash flows for year ended 30.9.2011.

Transcribed Image Text:

Statement of income year ended 30 September 2011 Sales revenue Cost of sales Gross profit Other expenses Interest Profit before taxation Taxation Dividends Retained profit Retained earnings b/f Retained earnings c/f £'000 8,000 (4,500) 3,500 (1,000) (14) 2,486 (800) (700) 986 4,400 5,386 Statement of financial position as at 30 September 2011 2010 Non-current assets (wdv) Current assets: Inventories Receivables Bank Current liabilities: Trade payables Dividend declared Taxation Long-term loans £'000 £'000 £'000 £'000 8,100 6,800 800 670 80 (420) (400) (635) 95 8,195 (1,200) 6,995 600 620 300 (340) (360) (595) 225 7,025 (1,400) 5,625

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

Notes a Disposal loss 310000 80000 proceeds 230000 b Depreciation 6800000 1...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

The following is Mann Corp.s comparative balance sheet at December 31, 2011, and 2010, with a column showing the increase (decrease) from 2010 to 2011: Additional information: 1. On December 31,...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Prepare a statement of cash flows for Abrahams Manufacturing Company for the year ended December 31, 2012. Interpret your results. Abrahams Manufacturing Company Income Statement for the Year Ended...

-

What are the "two main lines" of distortion of the view of Marx and what does Lenin think the proper view?

-

1. From the plans of Figure and the history of the project to date, is it realistic to think that the project will be completed with only a small amount of slippage? How do you know and could you say...

-

Define and discuss the three measures of organiza tional performance used by the theory of constraints. LO5

-

between 18 and 20 years old

-

Hatfield Medical Supply's stock price had been lagging its industry averages, so its board of directors brought in a new CEO, Jaiden Lee. Lee had brought in Ashley Novak, a finance MBA who had been...

-

The following information was taken from the accounts of Green Market, a delicatessen, at December 31, Year 2. The accounts are listed in alphabetical order, and each has a normal balance. Req A Req...

-

Statements of financial position of Fixem plc are shown. You are informed: (i) Non-current assets acquired for 120,000 and written down to 60,000 were sold in the year for 90,000. (ii) Depreciation...

-

Calculate the cash inflow/outflow during the year ended 31.12.2011. Income/expense for the year ended 31.12.2011 Sales Purchases Rent Salaries '000 1,680 1,246 60 246 As at 1.1.2011 Trade receivables...

-

Dweller, Inc. is considering a four-year project that has an initial after-tax outlay or after-tax cost of $80,000. The future cash inflows from its project are $40,000, $40,000, $30,000 and $30,000...

-

1. What are the threats being faced by Indian General Insurance Ltd. (IGIL)? 2. What are its traditional strengths? What 'business definitions' should it follow while capitalizing on its traditional...

-

You go to discuss the incident and the client's claims with your supervisor. As you retell the incident, it is clear that your supervisor is not comfortable. You ask your supervisor for advice on the...

-

Case Study Two: Rawlings Rawlings is an American sports equipment manufacturing company based in Town and Country, Missouri, and founded in 1887. Rawings specializes in baseball equipment and...

-

The discussion is for Administrating organizational change course. (we should write 300 words) Discussion question is: Refer to table 6.4 in your book. Think of a time when you were introduced to...

-

Content: Identify at least two resources for each of the four critical sections in the course project: Strategic Planning, Healthcare Reimbursement, Revenue Cycle Process, and Reimbursement...

-

When two cups of hot chocolate, one at 50C and the other at 60C, are poured into a bowl, why will the temperature of the mixture be between 50C and 60C?

-

On October 1, 2021, Adoll Company acquired 2,600 shares of its $1 par value stock for $38 per share and held these shares in treasury. On March 1, 2023, Adoll resold all the treasury shares for $34...

-

In your own words, explain how buying behavior of business customers in different countries may have been a factor in speeding the spread of international marketing.

-

Compare and contrast the buying behavior of final consumers and organizational buyers. In what ways are they most similar and in what ways are they most different?

-

Briefly discuss why a marketing manager should think about who is likely to be involved in the buying center for a particular purchase. Is the buying center idea useful in consumer buying? Explain...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

Study smarter with the SolutionInn App