Effect of capitalizing versus expensing on reported income. America Online. Inc. (AOL), offers the largest consumer on-line

Question:

Effect of capitalizing versus expensing on reported income. America Online.

Inc. (AOL), offers the largest consumer on-line service in the United States. Subscribers to its on-line service receive e-mail, on-line conferences, entertainment, software, computing support, an extensive newsstand of electronic magazines and newspapers, and seamless access to the Internet. Acquisitions in Year 5 and Year 6 permit it to offer a vertically integrated product and service line for users of the Internet.

The company aggressively attracts new subscribers to its on-line service through independent marketing programs, such as direct mail, disk inserts and inserts in publications, and advertising. It has also entered into co-marketing agreements with numerous personal computer hardware, software, and peripheral production companies.

These companies bundle AOL software with their products, thus facilitating easy trial use of the company's services. The company has also entered into co-marketing agreements with certain of its media partners to market directly to specific audiences.

AOL uses specialized retention programs designed to increase customer loyalty and satisfaction and to maximize customer subscription life. These retention programs include regularly scheduled on-line events and conferences, the regular addition of new content, services, and software programs, and on-line promotions of upcoming online events. The company also provides a variety of support mechanisms such as telephone customer-support services.

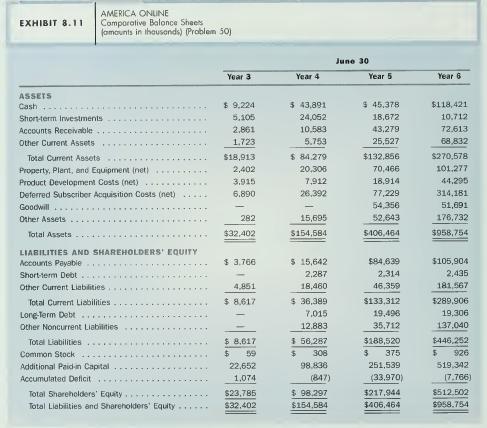

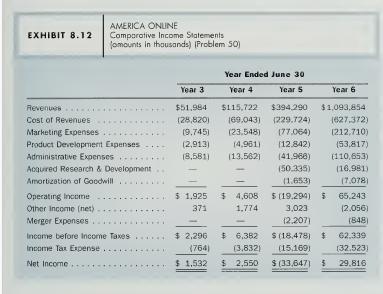

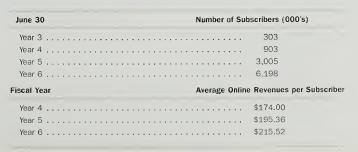

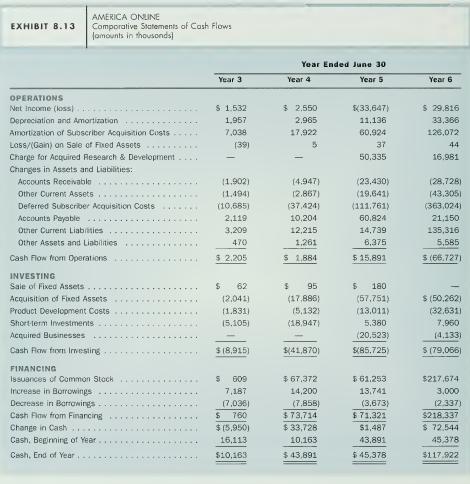

Exhibit 8.1 1 presents comparative balance sheets. Exhibit 8.12 presents comparative income statements, and Exhibit 8.13 presents comparative statements of cash flows for AOL for the Year 3 through Year 6 fiscal years. Selected notes to the financial statements appear below part g.

a. Describe the rationale that the company would likely make to its independent auditors to justify its practice of deferring and subsequently amortizing subscriber acquisition costs.

b. Prepare an analysis that accounts for the change in the Deferred Subscriber Acquisition Costs account on the balance sheet for each of the Year 3 through Year 6 fiscal years.

c. FASB Statcmcni af Financial Accoiiniini; Standards No. H6 requires finns to expense when incurred all costs of developing computer software until such time as the technological feasibility of the software has been established. Firms must capitalize and subsequently amortize software development and production costs incurred after establishing technological feasibility. FASB Statement of Financial Acc(Htntinf> Standards No. 2 requires firms to expense research and development

costs in the year incurred regardless of the subsequent success of the research ef forts. What justification can you see for these treatments of the costs of develop- ing new technologies?

d. Prepare an analysis that accounts for the change in the Product Development Costs account on the balance sheet for each of the Year 3 through Year 6 fiscal years.

e. FASB Interpretation No. 4 requires firms to expense in the year of a corporate ac- quisition any portion of the purchase price allocated to technologies that have not reached a stage of commercial feasibility as of the time of the acquisition (re- ferred to as in-process technologies). In contrast, firms must capitalize and subse- quently amortize any amounts allocated to commercially feasible technologies. (for example, a patent). What rationale can you see for this different accounting treatment?

f. Refer to the income statements for AOL, in Exhibit 8.12. Recompute the operating income for each of the Year 3 through Year 6 fiscal years assuming that AOL expensed subscription acquisition costs and product development costs in the year incurred instead of capitalizing and amortizing them, and excludes from operating income the charge for acquired research and develop- ment costs because of its materiality and nonrecurring nature. g. Identify the likely reasons for the changes in the operating profitability of AOL between the Year 3 and Year 6 fiscal years. (Hint: Using both originally reported amounts and the amounts restated in part

f. express operating expenses and oper- ating income as a percentage of revenues.) AOL reports the following information to aid your assessment of profitability.

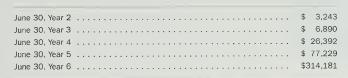

Notes to the AOL Financial Statements Revenue Recognition The Company recognizes on-line service revenue in the period that it provides services. Deferred Subscriber Acquisition Costs The Company defers subscriber acquisition costs and amortizes them as a charge to operations over a period determined by cal- culating the ratio of current revenues related to direct response advertising versus the total expected revenues related to this advertising, or twenty-four months (straight- line), whichever is shorter. The amortization begins the month after incurring such costs. These costs, which relase directly to subscriber solicitations, principally include printing, production and shipping of starter kits and the costs of obtaining qualified prospects by various targeting direct marketing programs (for example, direct marketing response cards, mailing lists) and from third parties. Subscriber acquisition costs include no indirect costs. To date, all subscriber acquisition costs relate to the solicitation of specific identifiable prospects. The Company expenses when incurred all marketing costs that are not targeted at specific identifiable prospects for the Company's services. The Company reports Deferred Subscriber Costs in the noncurrent assets section of its balance sheet as follows (amounts in thousands):

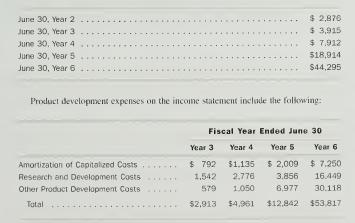

Product Development Costs The Company capitalizes costs incurred for the production of computer software used in the sale of its services. Costs capitalized include direct labor and related overhead for software produced by the Company and the costs of software purchased from third parties. All costs in the software development process that is classified as research and development are expensed when incurred until technological feasibility has been established. Once technological feasibility has been established, such costs are capitalized until the software is commercially available.

The Company amortizes capitalized software development costs on a product-byproduct basis, using the greater of the straight-line method or cuirent year revenue as a percent of total revenue estimates for the related software product not to exceed five years, commencing with the month after the date of product release.

Deferred product development costs appear on the balance sheet as a noncurrent asset as follows (amounts in thousands):

Business Acquisitions The Company made several corporate acquisitions during the Year 5 und Year 6 fiscal years. using a combination of cash and shares of the Com- pany's common stock. The aggregate purchase price exceeded the market value of the net assets acquired. The Company allocated a portion of the excess purchase price to in-process research and development of the acquired companies. Generally accepted accounting principles require the Company to expense in the year of the acquisition all amounts allocated to in-process research and development. The Company allocated any remaining excess purchase price in these acquisitions to goodwill, which the Company amortizes over ten years.

Income Taxes The Company treats subscriber actiiusition costs and product development costs as an expense in computing taxable income in the year that it incurs such costs. Income tax expense in the income statement includes a provision for income taxes that the Company saves in the year that it claims such tax deductions but must pay in later years as it amortizes such costs for financial reporting. The income tax law does not permit the Company to deduct expenditures for in-process research and development acqtiired in corporate acquisitions or merger expenses in computing taxable income.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil