Analysis of financial statements to compute the change in property and plant. assets required to sustain sales

Question:

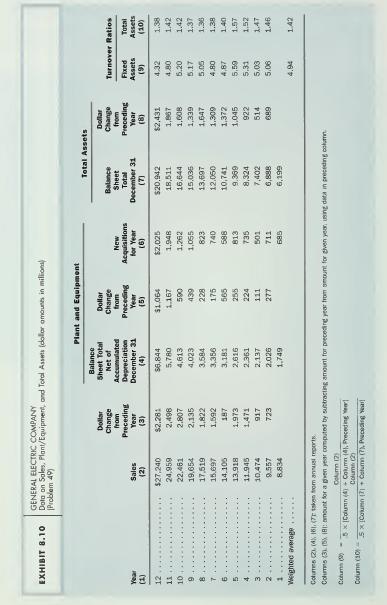

Analysis of financial statements to compute the change in property and plant. assets required to sustain sales growth. (Developed from a suggestion by Kather- ine Schipper). Exhibit 8.10 shows data from several years for General Electric Company (GE). Assume that analysis of GE's markets indicates that GE can sustain sales growth of 10 percent per year for the next several years. The corporate treasurer must plan ways to raise the new funds that will be required to finance the expansion of assets needed to support such increased sales. Assume that GE's financial policy calls for financing new property and plant with long-term financing, owners' equity (including earnings and retentions), and long-term borrowings. Financing for current assets, such as receivables and inventory, can he generated with current liabilities. such as increases in payables and short-term bank borrowings. Past relations appear in Exhibit 8.10; note the computation of the fixed asset turnover ratio and the total asset turnover ratio. These ratios show the average amount of sales per dollar of investment in plant and equipment and the average amount of sales per dollar of investment in total assets. The total asset turnover ratio averages

1.42, indicating that $1.42 of sales requires about $1.00 of total assets. Putting it another way. about $.70 (= $1/1.42) of assets is required for each dollar of sales. The average fixed asset turnover ratio of 4.94 indicates that about $1 of net property and plant is required for $4.94 of sales, or that $1 of sales requires about $.20 (= $1/4.94)

of property and plant. From these data, management has tentatively concluded that to increase sales by $1 will require about $.70 of new assets, of which about $.20 will be invested in new property and plant, with the remaining $.50 being invested in current assests such as receivables and inventories. Thus to increase sales by 10 percent, or $2.7 billion, will require about $1.9 (= .70 X $2.7) billion of new funds, with about $540 million (= .20 X $2.7 billion) required from long-term sources.

Can you sharpen and improve this analysis? Consider the incremental sales achieved by past incremental investments in both property/plant and total assets.

Consider that turnover ratios deal with average relations, whereas the questions at issue require analysis of incremental relations—how much additional investment is required for additional sales.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil