Straight-line depreciation is probably too conservative; it usually writes off an asset's cost faster than future benefits

Question:

Straight-line depreciation is probably too conservative; it usually writes off an asset's cost faster than future benefits disappear. (Requires coverage of the appendix.)

Firms acquire assets for tiie assets" future benefits—the future cash flows they produce, either cash inflows or savings of cash outflows. As the firm receives the near-term cash flows, the value of the future benefits declines, but the remaining future cash flows come closer to payoff time, increasing in value. The present value of future cash flows may, in total, increase or decrease during any one year. This problem explores changes in the present value of future cash flows with the passage of time and illustrates the phenomenon that, for many business projects, the present value of future benefits (that is, future cash flows) declines at a rate much slower than implied by straight-line depreciation.

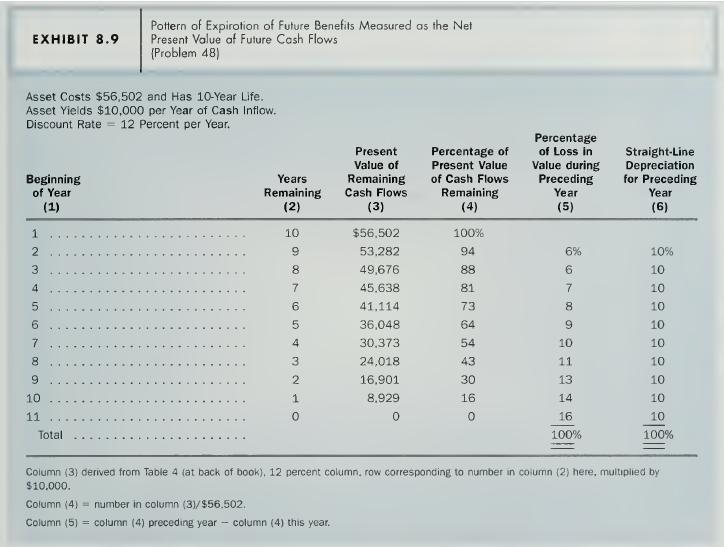

Pasteur Company plans to acquire an asset that will have a 10-year life and thai promises to generate cash flows of $10.()()0 per year at the end of each of the 10 years of its life. Given the risk of the project that uses the asset, Pasteur Company judges that a 12 percent rate is appropriate for discounting its future cash flows. Using a 12 percent discount rate, the present value of $1 received at the end of each of the next 10 years is $5.65022 (see Table 4 at the back of the book: 10-period row, 12 percent column). Because the firm expects the project to generate $10,000 per year, the present value of the cash flows is $56,502 (= $10,000 X 5.65022). Assume that Pasteur Company purchases the asset for exactly $56,502 at the beginning of Year 1 . Exhibit 8.9 shows for each year the present value of the cash flows remaining at the beginning of each year of the asset's life. The numbers in column (3) result from multiplying

$10,000 by the number appearing in Table 4, 12 percent column, for the number of periods remaining in the asset's life. Column (4) shows the percentage of the asset's present value of the cash flows remaining, and column (5) shows the percentage loss in present value of cash flows during the preceding year.

Column (6) shows the percentage write-off in cost each year using straight-line depreciation—10 percent per year. Note that the decline in present value of cash flows is less than straight-line in the first five years but greater in the last four years.

a. Construct an exhibit similar to Exhibit 8.9 for an asset with a five-year life promising $10,000 of cash flows at the end of each year. Use a discount rate of 15 percent per year. The asset costs $33,522. Compare the resulting decline in present value with straight-line depreciation.

b. Now consider another asset with a five-year life with risk appropriate for a 15 percent discount rate. This asset also has net present value of cash flows of $33,522, but the expected cash flows are $1 1,733 at the end of the first year, $10,727 at the end of the second year, $9,722 at the end of the third year, $8,716 at the end of the fourth year, and $7,710 at the the end of the fifth year. Construct an exhibit

similar to Exhibit 8.9 for this asset. You should find that the present value of future cash flows disappears at the rate of 20 percent of $33.522 per year, the ini- tial present value.

c. Using the results of your work, comment on the nature of conservatism of straight-line depreciation.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil