Effect of intercorporate investment policies on financial statements. Coca-Cola Company (Coke) and PepsiCo (Pepsi) dominate the soft

Question:

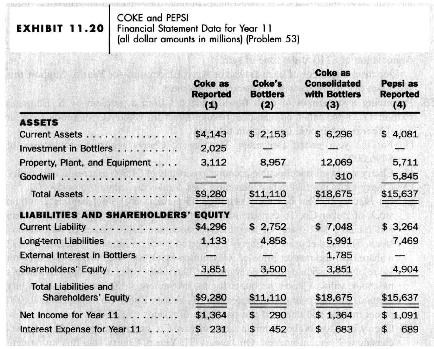

Effect of intercorporate investment policies on financial statements. Coca-Cola Company (Coke) and PepsiCo (Pepsi) dominate the soft drink industry in the United States and maintain leading market positions in many other countries. Coke has followed a policy of holding a 49 percent ownership interest in its bottlers, whereas Pepsi wholly owns its bottling operations. Exhibit 11.20 presents selected balance sheet data for Coke and Pepsi for Year 11.

The first column shows amounts for Coke as reported, with Coke using the equity method to account for investments in its bottlers. The second column shows amounts for Coke's bottlers as reflected in a note to Coke's financial statements. The third column shows consolidated amounts for Coke and its bottlers. The 51 percent external interest in these bottlers appears on a line between liabilities and shareholders' equity. The fourth column shows amounts for Pepsi as reported, with its bottlers consolidated.

a. Compute the rate of return on assets for Year 11 under each of the four treatments in Exhibit 11.20. Assume an income tax rate of 34 percent. Also assume that the amounts shown for total assets in Exhibit 11.20 approximate the average assets for Year 11 .

b. Compute the ratio of total liabilities to total assets at the end of Year 11 under each of the four treatments in Exhibit 11.20.

c. Evaluate the operating profitability and risk of Coke versus Pepsi using the ratios computed in questions a and \(\mathbf{b}\).

d. Suggest reasons why Coke might choose to own 49 percent of its bottlers whereas Pepsi holds 100 percent of its bottlers.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil