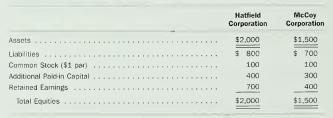

Effect of purchase and pooling-of-interests methods on financial statements. (Requires coverage of Appendix 11.2.) Hatfield Corporation and

Question:

Effect of purchase and pooling-of-interests methods on financial statements. (Requires coverage of Appendix 11.2.) Hatfield Corporation and McCoy Corporation agree to merge on January 1. Year 8, when the balance sheets of the two companies appear as follows (amounts in thousands):

Hatfield issues 50,000 shares of its common stock with a market value of $1,400.000 to the owners of McCoy in return for their 100,000 shares of McCoy Corporation common stock. The recorded assets of McCoy Corporation have a market value in excess of book value of $400,000,

a. Prepare a consolidated balance sheet for Hatfield Corporation and McCoy Corpo- ration on January 1. Year 8., using (1) the purchase method and (2) the pooling-of- interests method

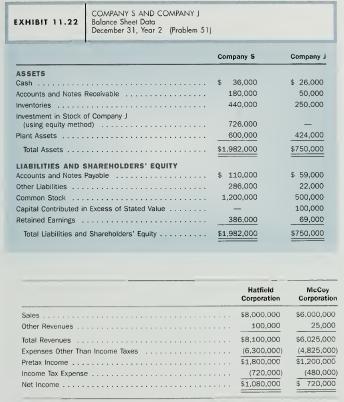

b. Projected partial income statements for Hatfield Corporation and McCoy Corpo- ration for Year 8 before considering the effects of the merger appear below.

Make the following assumptions:

(1) The income tax rate for the consolidated firm is 40 percent.

(2) Where necessary, Hatfield Corporation amortizes the extra asset costs over five years and the goodwill over 10 years in the consolidated statements, (3) In calculations for tax returns. Hatfield Corporation cannot deduct, from taxable income, amortization of asset costs and goodwill arising from the purchase.

(4) McCoy Corporation declared no dividends.

Prepare consolidated income statements and consolidated earnings per share for the first year following the merger. Assume that the merger is treated as ( 1 ) a purchase and (2) a pooling of interests.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil