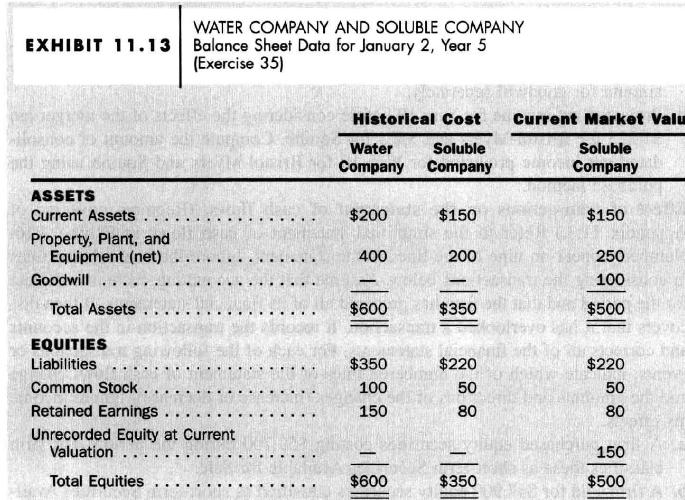

Financial statement effects of the purchase method. (Requires coverage of Appendix 11.2.) Exhibit 11.13 presents condensed balance

Question:

Financial statement effects of the purchase method. (Requires coverage of Appendix 11.2.) Exhibit 11.13 presents condensed balance sheet data for Water Company and Soluble Company on January 2, Year 5. On this date, Water Company exchanges common stock with a par value and market value of \(\$ 280\) for all of the outstanding common stock of Soluble Company.

a. Give the journal entry on Water Company's books to record the acquisition of Soluble Company's common stock.

b. Give the work-sheet entry to eliminate the investment account on January 2, Year 5 in order to prepare consolidated financial statements.

c. Prepare a consolidated balance sheet for Water Company and Soluble Company as of January 2, Year 5, using the purchase method.

d. Projected net income for Year 5 before consideration of the corporate acquisition is \(\$ 60\) for Water Company and \(\$ 20\) for Soluble Company. Neither firm expects to

pay a dividend during Year 5. These firms intend to amortize any excess acquisition cost allocated to property, plant, and equipment over five years. Give the entries that Water Company will make on its books to apply the equity method during Year 5 assuming that the actual net incomes equal those projected.

e. Compute the amount of consolidated net income for Year 5 assuming that these firms account for the corporate acquisition using the purchase method.

f. Give the work-sheet entry to eliminate the investment account on December 31, Year 5 in order to prepare consolidated financial statements.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil