Give correcting entries for the following situations. In each case. the firm uses the straightline method of

Question:

Give correcting entries for the following situations. In each case. the firm uses the straightline method of depreciation and closes its books annually on December 31. Recognize all gains and losses currently.

a A cash register was purchased for \(\$ 300\) on January 1, 1974. It was depreciated at a rate of 10 percent. On June 30, 1979, it was sold for \(\$ 200\) and a new cash register was acquired for \(\$ 500\). The bookkeeper made the following entry to record the transaction:

![]()

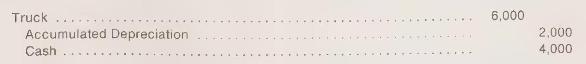

b A used truck was acquired in May 1979 for \(\$ 4,000\). Its cost when new was \(\$ 6,000\), and the bookkeeper made the following entry to record the purchase:

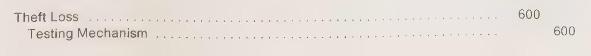

c A testing mechanism was purchased on April 1, 1977, for \(\$ 600\). It was depreciated at a 10 -percent annual rate. On June 30, 1979, it was stolen. The loss was not insured, and the bookeeper made the following entry:

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney