Identifying quality-of-earnings issues. Petite-Marts, Inc., maintains a chain of U.S. retail clothing stores offering stylish women's clothes

Question:

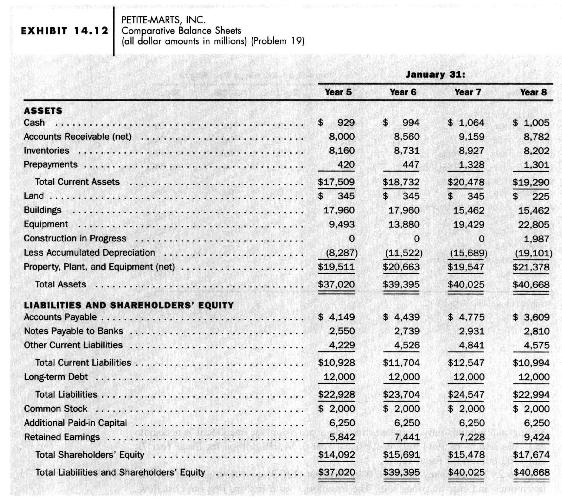

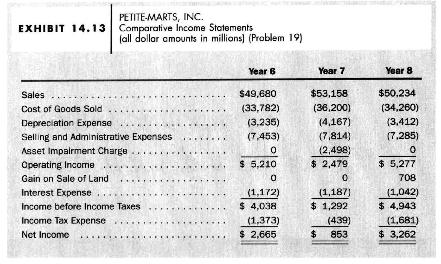

Identifying quality-of-earnings issues. Petite-Marts, Inc., maintains a chain of U.S. retail clothing stores offering stylish women's clothes in petite sizes. The company offers its own credit card and charges no interest on unpaid balances of three months or less. Exhibit 14.12 presents balance sheets for January 31, Year 5, to January 31, Year 8. Exhibit 14.13 presents income statements, and Exhibit 14.14 presents statements of cash flows for the three fiscal years ending January 31, Year 6 to Year 8. Excerpts from the notes to the financial statements appear below.

Note 1: The company recognizes revenue at the time of sale to customers. Accounts receivable are net of an allowance for uncollectible accounts and sales returns of \(\$ 1,438\) million on January 31, Year 5, \(\$ 1,785\) million on January 31, Year 6, \$2,010 million on January 31, Year 7, and \(\$ 1,759\) million on January 31, Year 8.

Selling and administrative expenses include a provision for uncollectible accounts and sales returns of \(\$ 994\) million for fiscal Year 6, \(\$ 1,010\) million for fiscal Year 7, and \(\$ 703\) million for fiscal Year 8.

Note 2: The company uses a last-in, first-out (LIFO) cost flow assumption for inventories and cost of goods sold. The inventories on a first-in, first-out cost flow assumption would have exceeded their LIFO amounts as follows: January 31, Year 5, \$2,448 million; January 31, Year 6, \$2,969 million; January 31, Year 7, \$3,572 million; January 31, Year 8, \$2,247 million. During fiscal Year 8 the company dipped into LIFO layers created in earlier years, increasing income before income taxes by \(\$ 916\) million.

Note 3: The company uses the straight-line depreciation method. It depreciates buildings over 20 years and, until fiscal Year 8, depreciated equipment over 5 years. A review of equipment usage early in fiscal Year 8 suggested that a longer depreciable life was appropriate. The company therefore revised the depreciable lives of equipment from 5 years to 8 years beginning with the Year 8 fiscal year. The change decreased depreciation expense for fiscal Year 8 by \(\$ 1,583\) million. During fiscal Year 7 , new federal health and safety regulations led to the need to recognize a building impairment loss totaling \(\$ 2,498\) million. The company commenced construction of a new home office building during fiscal Year 8. It incurred total costs of \(\$ 1,987\) million, including \(\$ 147\) million of capitalized interest.

Note 4: The company expenses advertising costs in the year the advertisement appears. Advertising expense was \(\$ 1,987\) million in fiscal Year \(6, \$ 2,179\) million in fiscal Year 7 , and \(\$ 1,859\) million in fiscal Year 8.

Note 5: The company is subject to an income tax rate of 34 percent.

a. Identify quality-of-earnings issues in the income statements for fiscal Year 6, Year 7 , and Year 8.

b. Recompute net income for each of the three years as you think appropriate in light of the quality-of-earnings issues discussed in part a.

c. Discuss the changes in profitability of Petite-Marts, Inc., during the three-year period.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil