Impact of two sets of alternative accounting principles on net income and cash flows. Brown Corporation commences

Question:

Impact of two sets of alternative accounting principles on net income and cash flows. Brown Corporation commences operations on January 2, Year 1, with the issuance at par of 100,000 shares of \(\$ 10\)-par value common stock for cash. During Year 1, the following transactions occur.

(1) Brown Corporation acquires the assets of Joan's Department Store on January 2, Year 1, for \(\$ 600,000\) cash. The market values of Joan's identifiable assets are as follows: accounts receivable, \(\$ 150,000\); merchandise inventory, \(\$ 300,000\) ( 150,000 units); store equipment, \(\$ 112,500\); and goodwill, \(\$ 37,500\).

(2) During the year, the firm sells 157,500 units at an average price of \(\$ 3.20\).

(3) The firm offers extensive training programs during the year to acquaint previous employees of Joan's Department Store with the merchandising policies and procedures of Brown Corporation. The costs incurred in the training programs total \(\$ 37,500\).

(4) Selling, general, and administrative costs incurred and recognized as an expense during Year 1 are \(\$ 60,000\).

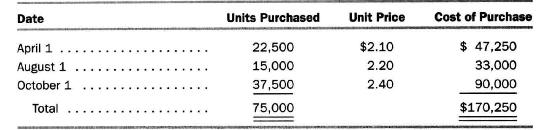

(5) Brown Corporation purchases, on account, merchandise inventory during Year 1 as follows:

On December 31, Year 1, Brown Corporation owes \(\$ 30,200\) for purchases on account.

(6) Brown Corporation estimates the store equipment to have a 10 -year useful life and zero salvage value.

(7) The income tax rate is 30 percent.

The management of Brown Corporation is uncertain about the accounting methods that it should use in preparing its financial statements. It narrows the choice to two sets of accounting methods and asks you to calculate net income for Year 1 using each set.

Set A consists of the following accounting methods (for book and tax purposes): LIFO inventory cost flow assumption, accelerated depreciation, and immediate expensing of the costs of the training program. Set A computes depreciation using the double declining-balance method for book purposes ( 10 -year useful life and zero estimated salvage value). Accelerated depreciation for tax purposes is \(\$ 16,073\).

Set \(\mathrm{B}\) consists of the following accounting methods: FIFO inventory cost flow assumption, straight-line depreciation for book purposes (10-year life and zero estimated salvage value), and capitalization and amortization of the costs of the training program over five years for book and immediate expensing for tax purposes. Accelerated depreciation for tax purposes is \(\$ 16,073\).

a. Calculate the net income for Year 1 under each set of accounting methods.

b. Calculate cash flow from operations under each set of accounting methods. Assume that accounts receivable total \(\$ 120,000\) and accounts payable total \(\$ 30,200\) at year-end. Also assume that one-fourth of the income taxes payable on the current year's taxable income remains unpaid at year-end.

c. Prepare an analysis that explains the difference in cash flow from operations under Set A and Set B.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil