Impact of alternative accounting principles on two firms. On January 1, Year 1, two corporations establish merchandising

Question:

Impact of alternative accounting principles on two firms. On January 1, Year 1, two corporations establish merchandising businesses. The firms are alike in all respects except for their methods of accounting. Humble Company chooses the accounting principles that minimize its reported net income. Huff Company chooses the accounting principles that maximize its reported net income but, where permitted, uses accounting methods that minimize its taxable income. The following events occur during Year 1 .

(1) Both firms issue 500,000 shares of \(\$ 1\)-par value common shares for \(\$ 8\) per share on January 1, Year 1.

(2) Both firms acquire equipment on January 2, Year 1, for \(\$ 2,750,000\) cash. The firms estimate the equipment to have a 10 -year life and zero salvage value

(3) Both firms engage in extensive sales promotion activities during Year 1, incurring costs of \(\$ 375,000\).

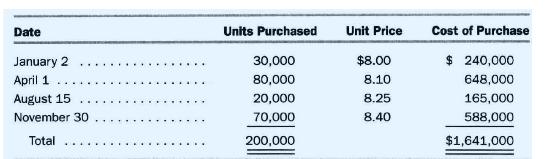

(4) The two firms make the following purchases of merchandise inventory, on account.

On December 31, Year 1, purchases of inventory on account totaling \(\$ 310,000\) remain unpaid.

(5) During the year, both firms sell 150,000 units at an average price of \(\$ 18\) each.

(6) Selling, general, and administrative expenses, other than advertising, total \(\$ 150,000\) during the year.

Humble Company uses the following accounting methods (for both book and tax purposes): LIFO inventory cost flow assumption, accelerated depreciation, and immediate expensing of the costs of sales promotion. It uses the sum-of-theyears'-digits depreciation method for financial reporting and the allowable accelerated depreciation method for tax purposes. For tax purposes, depreciation on this equipment is \(\$ 293,700\) for Year 1.

Huff Company uses the following accounting methods: FIFO inventory cost flow assumption for both book and tax purposes, the straight-line depreciation method for book and the allowable accelerated depreciation method for tax purposes, and capitalization and amortization of the costs of the sales promotion campaign over four years for book and immediate expensing for tax purposes.

a. Prepare comparative income statements for the two firms for Year 1. Include separate computations of income tax expense. The income tax rate is 30 percent.

b. Prepare comparative balance sheets for the two firms as of December 31, Year 1. Both firms have \(\$ 1,300,000\) of outstanding accounts receivable on this date. Each firm has a current liability for unpaid income taxes equal to onefifth of the taxes payable on the current year's taxable income.

c. Prepare comparative statements of cash flows for the two firms for Year 1, defining funds as cash.

d. Prepare an analysis that explains the difference in the cash of Humble Company and that of Huff Company on December 31, Year 1.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil