Information stated below is in respect of a business which commenced several years ago. Office equipment and

Question:

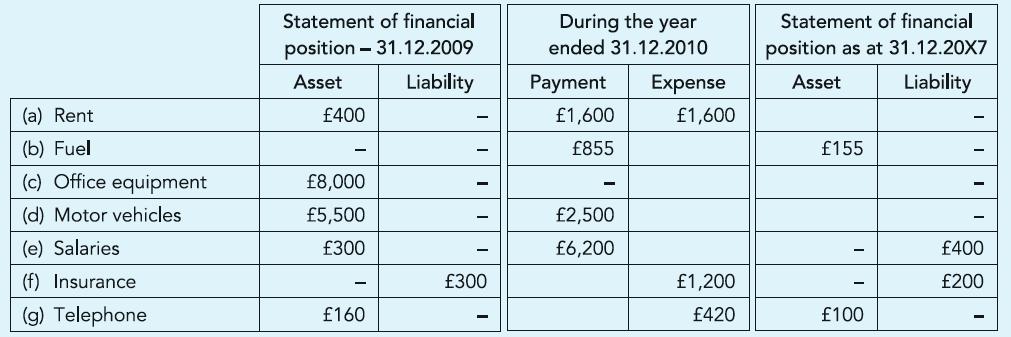

Information stated below is in respect of a business which commenced several years ago.

Office equipment and motor vehicles are depreciated at 20% and 25% per annum respectively, using the straight-line method. New vehicles were paid for on 1.1.2010.

Required:

Fill in the blanks with appropriate figures.

Transcribed Image Text:

(a) Rent (b) Fuel (c) Office equipment (d) Motor vehicles. (e) Salaries (f) Insurance (g) Telephone Statement of financial position - 31.12.2009 Asset Liability £400 £8,000 £5,500 £300 £160 - £300 During the year ended 31.12.2010 Payment £1,600 £855 £2,500 £6,200 Expense £1,600 £1,200 £420 Statement of financial position as at 31.12.20X7 Asset Liability £155 £100 - - - £400 £200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

a Rent b Fuel c Equipment d Motor veh...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

The following figures have been extracted from the accounting records of Lavalamp on 30 September 20X3: (i) Lavalamp has spent $6 million (included in the cost of sales) during the year developing...

-

Assume that you are the owner of a wholesale store and that you operate as a sole trader. On April 1, 2019 you had the following items in your business: Stock, $14,500,000; Motor vehicles,...

-

The trial balance for LPO at 31 December 2013 was as follows: Notes: (i) Closing inventory at 31 December 2013 was $562,000. (ii) On 31 December 2013, LPO disposed of some obsolete plant and...

-

In this study researchers found a correlation between the cleanliness of the homes children are raised in and the years of schooling completed and earning potential for those children What...

-

What is of the following components of a CEO contract is defined as the payment the company will make to the CEO in the event that the ownership of the company changes? A. Say-on-pay B. Vested stock...

-

Multiple allocation bases.' : R efer to Case 46. Jean Sharpe decides to gather additional data to identify the cause of overhead costs and figure out which products are most profitable. Jean notices...

-

Determine which pairs of models that follow are nested models. For each pair of nested models, identify the complete and reduced model. a. E1y2 = b0 + b1 x1 + b2 x2 b. E1y2 = b0 + b1 x1 c. E1y2 = b0...

-

Rosenberg Land Development (RLD) is a developer of condominium properties in the Southwest United States. RLD has recently acquired a 40.625 acre site outside of Phoenix, Arizona. Zoning restrictions...

-

Presented below ore financial statements ( except cash flows ) for two not - for - profit organizations. Neither organization has any permanently restricted net sssets. Required: a . Calculste the...

-

Staff salary remaining unpaid as at the year-end should be accounted for as: (a) Debit Staff salary account and credit Cash account (b) Debit Staff salary account and credit Salary accrued account...

-

The year-end Trial Balance of a business owned by Frances Inglish is shown. You have been provided with following information: (a) On the basis of an inventory count conducted on 7 July 2010, the...

-

Give examples of how a hospitality organization might be able to gain publicity.

-

Analysis of workforce data, performance, and engagement. Datasets: Employees Table Column Name Data Type Description employee_id Integer Unique identifier for each employee department_id Integer...

-

Discuss your observations of the Data Wrangling process. Does this exercise highlight why data wrangling and preparation can take up 60-70% of the total data analysis process? it does. How do i say...

-

Examine potential implications od regulations, legislation and standards upon decision making in a hospitality organisation, providing specific examples

-

54. .. A baton twirler in a marching band complains that her baton is defective (Figure 9-48). The manufacturer specifies that the baton should have an overall length of L = 60.0cm and a total mass...

-

New United Motor Manufacturing, Inc. was an American automobile manufacturing company in Fremont, California , jointly owned by General Motors and Toyota that opened in 1 9 8 4 and closed in 2 0 1 0...

-

Suppose the following data represent the market demand for catfish: Price (per unit) ....................................... $20191817161514131211 Quantity demanded (units per day) ...................

-

Whats the difference between an ordinary annuity and an annuity due? What type of annuity is shown below? How would you change the time line to show the other type of annuity?

-

Exhibits 12.20 and 12.21 present selected information from the notes to the financial statements of Treadaway, Inc., a tire manufacturing company, regarding its U.S. pension and health care...

-

Exhibit 12.22 presents selected information from the notes to the financial statements of Catiman Limited, a manufacturer of farming equipment, for the years ending October 31, 2013, 2012, and 2011....

-

Exhibit 12.23 presents information from the income tax note to the financial statements for E-Drive, a European computer manufacturer, for the years ending December 31, 2013, 2012, and 2011. E-Drive...

-

Comfort Golf Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Stenback Inc. costs $1,000,000 and will last five years and have...

-

Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 71,000 shares of $10 par common stock. 8,500 shares of $60 par, 6 percent, noncumulative preferred stock. On...

-

Read the following case and then answer questions On 1 January 2016 a company purchased a machine at a cost of $3,000. Its useful life is estimated to be 10 years and then it has a residual value of...

Study smarter with the SolutionInn App