Interpreting profitability and risk ratios. International Paper Company is the largest integrated paper company in the world.

Question:

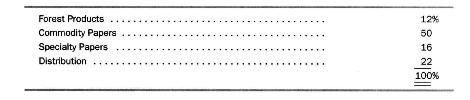

Interpreting profitability and risk ratios. International Paper Company is the largest integrated paper company in the world. It grows timber in its forests, processes the harvested timber into various commodity and specialty papers in its capital-intensive plants, and distributes various paper products through wholesale and retail outlets. Its average sales mix in recent years is as follows:

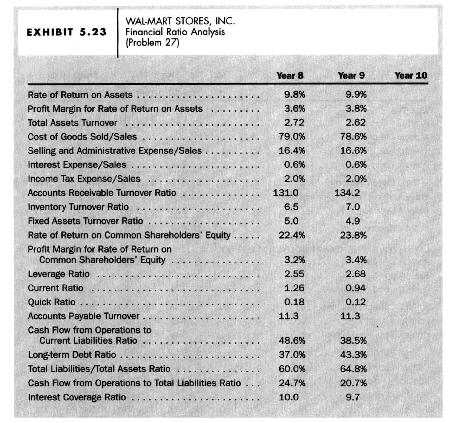

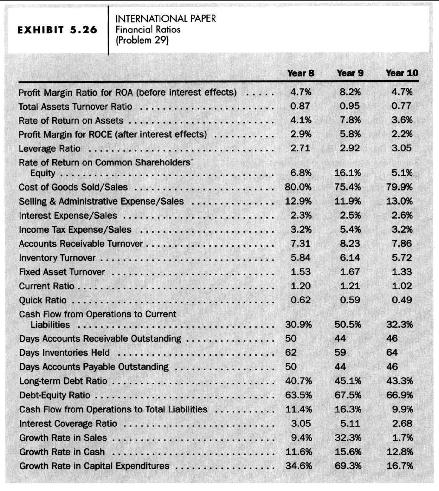

Exhibit 5.26 presents financial statement ratios for International Paper for Year 8, Year 9, and Year 10. Respond to each of the following questions.

a. What are the likely reasons for the decrease in the cost of goods sold to sales percentage from 80.0 percent in Year 8 to 75.4 percent in Year 9?

b. What are the likely reasons for the decrease in the fixed asset turnover from 1.67 in Year 9 to 1.33 in Year 10?

c. Did financial leverage work to the advantage of the common shareholders in Year 10 ? Explain in such a way that indicates your understanding of the concept of financial leverage.

d. What are the likely reasons for the decrease in the current ratio from 1.21 in Year 9 to 1.02 in Year 10?

e. What are the likely reasons for the decrease in the cash flow from operations to total liabilities ratio from 16.3 percent in Year 9 to 9.9 percent in Year 10?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil