Interpreting profitability and risk ratios. Marks & Spencer operates a chain of department stories located primarily in

Question:

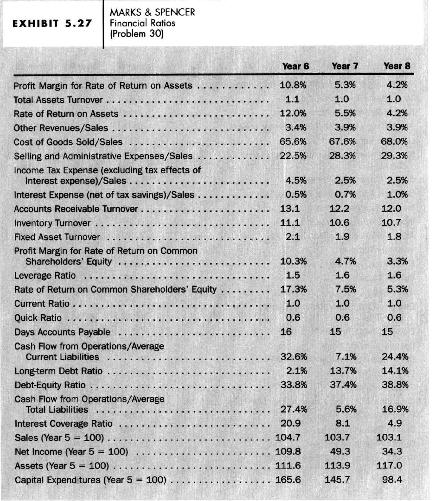

Interpreting profitability and risk ratios. Marks \& Spencer operates a chain of department stories located primarily in the United Kingdom. Exhibit 5.27 presents financial statement ratios for Marks \& Spencer for Year 6, Year 7, and Year 8.

a. What are the likely reasons for the increase in the cost of goods sold to sales percentages during the three years?

b. What are the likely reasons for the increase in the selling and administrative expense to sales percentages during the three years?

c. What are the likely reasons for the decrease in the income tax expense (excluding tax effects of interest expense) to sales percentages during the three years?

d. What are the likely reasons for the decrease in the fixed asset turnover during the three years?

e. What are the likely reasons for the increase in interest expense (net of tax effects) to sales percentages during the three years?

f. Did financial leverage work to the advantage of the common shareholders in each year? Explain.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil