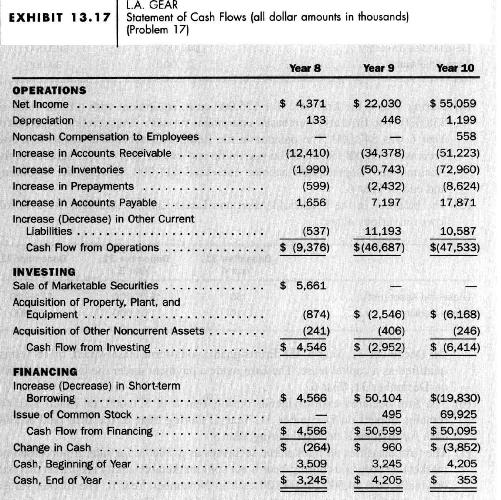

Interpreting the statement of cash flows. Exhibit 13.17 presents a statement of cash flows for L.A. Gear,

Question:

Interpreting the statement of cash flows. Exhibit 13.17 presents a statement of cash flows for L.A. Gear, manufacturer of athletic shoes and sportswear, for three recent years.

a. What is the likely reason for the negative cash flow from operations?

b. How did L.A. Gear finance the negative cash flow from operations during each of the three years? Suggest reasons for L.A. Gear's choice of financing source for each year.

c. Expenditures on property, plant, and equipment substantially exceeded the addback for depreciation expense each year. What is the likely explanation for this difference in amounts?

d. The addback for depreciation expense is a relatively small proportion of net income. What is the likely explanation for this situation?

e. L.A. Gear had no long-term debt in its capital structure during Year 7 through Year 9 . What is the likely explanation for such a financial structure?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil